But these times same as the time of the oil embargo imposed by OPEC in 1973 at the KSA’s initiative to exert pressure on Western countries and make them change their policy regarding the Arab-Israeli conflict are long gone. Nowadays, neither OPEC nor Saudi Arabia can have a decisive influence on the international oil markets and the oil prices although Saudi Aramco, which is competing with Russia for first place in global oil production, produces up to 10.1 million barrels per day. In the last 40 years, the international market has seen the emergence of new players – Angola, Mexico, Venezuela and, most recently, the USA. American companies have not just reactivated old oil wells but also introduced to the market (only to the domestic market for now) a relatively new product – shale gas, the price for which, according to Saudi experts’ report published in the Saudi Gazette on 18 December of this year, has now dropped in North America from 13 dollars per million British thermal units (BTU) in 2008 to 4.29 dollars per million BTU in 2013.

As a result, their dependence on oil imports, due to which they have previously had to interfere in Middle Eastern matters, started to decrease drastically. According to the predictions of the International Energy Agency, by 2020 the USA will have become the world’s oil production leader leaving behind both Saudi Arabia and Russia. At approximately the same time (2018-2022), the United States will achieve energy independence, and by 2030 (according to a pessimistic forecast – by 2035) it will have turned into a net energy exporter. Even now, hydrocarbon supplies from the countries of the Persian Gulf to the USA do not exceed 10% of the overall oil production in the region, claims Daniel Yergin, head of Cambridge Energy Research Associates (CERA). In other words, Washington is not so much dependent on this region strategically as in the previous decades and, in fact, is even capable to reduce this dependence to zero in the coming years. Anyway, this dependence does not play a crucial role for the USA from now on, hence the US margin for political manoeuvre is increasing, which the USA has already demonstrated this year by the attempts to enter into a new configuration of its relations with Iran.

But Saudi Arabia is a different matter. Its margin for manoeuvre is shrinking. 90% of Riyadh’s revenue depends on oil and its price. The main consumers of Saudi hydrocarbons are now not the USA (it consumes 12% of the oil produced in the KSA), but China (more than 40 million tonnes a year out of about 250 million tonnes produced in the KSA), India and Southeast Asian countries. Moreover, this rapidly developing region is buying more and more oil from the Gulf countries.

Despite its strenuous attempts to develop the non-raw materials sector (petrochemistry, the production of aluminium, titanium and other metals), experts are positive that in the coming decades the KSA will not be able to significantly get rid of its oil dependence. And all indicators show that the country’s position in the energy sphere will be only getting worse and its capability to affect the policy of the leading Western countries will be reducing. This is caused by objective factors.

The fact is that, in the last 30 years, the KSA’s population has increased four-fold – from 5 to 20 million people (according to the 2010 census), and inclusive of foreign workers – to 28 million people, although unofficial estimates suggest the figure of 35 million people (if you also include illegal immigrants, against whom the Saudi authorities are now fighting tooth and nail). The country’s internal consumption of petroleum products has increased accordingly. It now constitutes 28% of the total volume of oil production, which virtually has not changed. If no decisive measures are undertaken, then by 2030 the country will be consuming nearly all of its oil. This means the KSA’s death since the country does not have any other significant sources of revenue, apart from oil. And they are unlikely to appear considering the complete closure by 2016 of the majority of the agricultural projects (grain, poultry farming) generating exports because of the depletion of water sources.

So how can these acute problems be solved? There are some solutions, both economic and political.

Probably, there will be a need for painful internal reforms in the economy. As Western experts point out, it is absolutely necessary to gradually refuse from subsidising the oil and electricity prices, which have remained unchanged for the last thirty years. In the KSA, a litre of petrol costs 15 cents – and that is an important factor for political stability. But this over-the-top cheapness encourages people’s wastefulness, who are used to driving huge off-road vehicles and having their air conditioners switched on 24 hours a day. It is clear that they cannot carry on living like that and that one day they will have to reject this economic model.

In the energy sector, they will have to start using nuclear power and as soon as possible make a decision on the construction of a complex of nuclear plants. The KSA has already been talking of the need to build 16 nuclear power units for two years but of no avail. There is still no sign of specialists, there are no contracts signed with foreign companies, although the negotiations with a Japanese-French consortium are in their advanced phase. But everyone knows that building a nuclear power plant takes between 6 and 12 years, which means that there is very little time left for the implementation of the projects.

The implementation of the widely touted solar energy projects has just started, and it is not clear whether they will play a significant role in energy production considering the technological problems associated with the adjustment of solar panels to Saudi Arabia’s hard climatic conditions – sand storms, sharp fluctuations of temperature etc. It is unlikely that solar stations will be able to significantly replace oil in the country’s economy.

Gasification of the country is a promising matter. Natural gas reserves, including in gas and condensate fields, are enormous in the KSA. But the implementation of such a major project will require large investments and, again, time, which is running out inexorably.

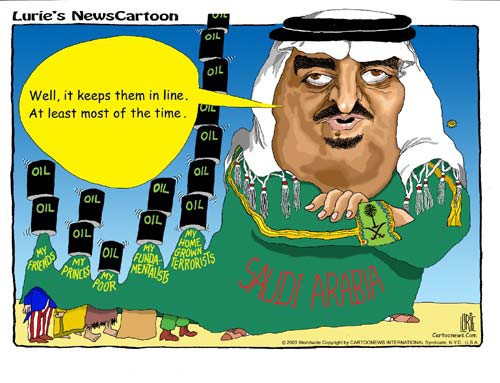

With regard to the foreign policy changes which could help the KSA to cope with the complex economic problems brewing up in the country, the voice of reason says that for Riyadh it will be good, first of all, to shift from the costly foreign policy of recent years and the ambitious projects of supporting the Arab “revolutions” on the basis of the export of home-grown ideology, which have already failed the leadership of Qatar; to withdraw from the exhausting and expensive confrontation with Iran (the support for the opposition in Syria alone costs billions); to search for compromise agreements with Tehran on the issues of security in the Persian Gulf instead of creating military-political blocs which have questionable goals (it is in its framework that it is planning to establish a single regional missile defence matching American systems) and which are not finding support among the neighbouring countries either.

Such agreements with the involvement of the great Powers may result in the creation in the Gulf region – in the case of the successful solution of the Iranian nuclear programme problem and settlement of the Syria crisis – of a collective security system similar to the one which has existed and quite successfully operated for nearly 40 years in Europe. In the event of such geopolitical choice (it is obvious that it needs to be supported by Iran as well), the KSA can get support from the world’s leading economies interested in ensuring stability in this rather sensitive region.

Pogos Anastasov, political analyst, orientalist, exclusively for the online magazine New Eastern Outlook.

del.icio.us

del.icio.us

Digg

Digg

Les commentaires sont fermés.