Un document à posséder pour argumenter lors des séminaires de l'école des cadres ! Bien sûr, cum grano salis, comme pour toutes les publications parisiennes qui véhiculent toujours des germes délétères de jacobinisme, l'idéologie de la terreur qui a justement généré le libéralisme !

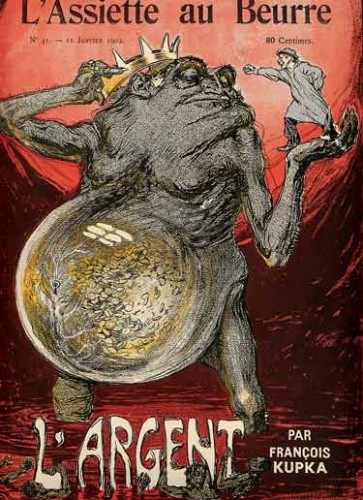

En kiosque depuis quelques semaines, un très intéressant numéro du bimensuel Manière de Voir (numéro de décembre-janvier) consacré au krach du libéralisme.

lundi, 18 janvier 2010

Dubai und Griechenland waren nur der Weckruf

»Dubai und Griechenland waren nur der Weckruf«

»Dubai und Griechenland waren nur der Weckruf«

Sind Staatsanleihen sicher? Ja natürlich! – Glauben Sie dieses Märchen noch? Thomas Mayer, der neue Chefvolkswirt der Deutschen Bank in Frankfurt, warnt jetzt vor den Risiken.

Thomas Mayer ist nicht irgendwer. Vor seiner Tätigkeit als Chefvolkswirt der Deutschen Bank waren das Kieler Institut für Weltwirtschaft, der Internationale Währungsfonds, Solomon Brothers und Goldman Sachs seine Stationen. Ein Mann also mit Reputation, dem man keinesfalls den Ruf eines »Verschwörungstheoretikers« nachsagen kann.

Im Handelsblatt gab er nun ein Interview zu »Risiken bei Staatsanleihen«. Auf die Frage, was im Jahr 2010 die beherrschenden Themen sein werden, antwortete er: »Die Risiken bei Staatsanleihen, ganz klar. Griechenland und Dubai waren nur der Weckruf – das System bricht schließlich nie an der dicksten Stelle zuerst.«

Die Frage, welche Länder ihm Sorgen machen, beantwortete er so: »Von den großen Volkswirtschaften vor allem Japan und Großbritannien. In Japan beträgt die Staatsverschuldung inzwischen 200 Prozent des Bruttoinlandsproduktes, Deflation ist wieder ein großes Thema und die Alterung der Bevölkerung hat brutal begonnen. Wer soll der älteren Generation die Rentenpapiere, die zu mehr als 90 Prozent in heimischer Hand sind, abkaufen? Auch in Großbritannien liegen die Risiken auf der Hand: Das Land war besonders exponiert im Finanz- wie auch im Immobiliensektor, wo die Krise bekanntlich ausbrach.«

»Was kommt schlimmstenfalls auf Japan und Großbritannien zu?« Antwort Thomas Mayer: »Die Entwertung der Staatsschuld durch Inflation.« Für ihn ist dieses Szenario »ein nennenswertes Risiko«.

Und dann macht er noch eine »verräterische« Äußerung: »Das Risiko unmittelbarer Zahlungsunfähigkeit ist allerdings vor allem in Ländern von Bedeutung, die keine Hoheit über die eigene Währung haben – beispielsweise Griechenland oder Irland.«

Oder Deutschland – könnte man hinzufügen, denn auch wir haben keine Hoheit über eine eigene Währung. Wir sind durch die Mitgliedschaft in der europäischen Wirtschafts- und Währungsunion beinahe unentrinnbar an den Euro gekettet. Unsere Steuerzahler subventionieren sogar all jene Länder, die seither das Geld nur so mit den Händen hinausgeworfen haben und jetzt kurz vor dem Bankrott stehen.

Aber das offen auszusprechen, davor scheut sich auch Thomas Mayer.

Dienstag, 12.01.2010

© Das Copyright dieser Seite liegt, wenn nicht anders vermerkt, beim Kopp Verlag, Rottenburg

Dieser Beitrag stellt ausschließlich die Meinung des Verfassers dar. Er muß nicht zwangsläufig die Meinung des Verlags oder die Meinung anderer Autoren dieser Seiten wiedergeben.

00:20 Publié dans Economie | Lien permanent | Commentaires (0) | Tags : économie, finances, crises, banques, ploutocratie |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

dimanche, 29 novembre 2009

Kapitalistische Amokfahrt

Kapitalistische Amokfahrt

Kapitalistische Amokfahrt

Claus WOLFSCHLAG - Ex: http://www.sezession.de/

Die neue schwarz-gelbe Bundesregierung scheint nur noch ein Allheilmittel gegen den Zusammenbruch der Staatsfinanzen und des sozialen Sicherungssystems zu kennen: „Wachstum“. Er sei die beste Antwort auf die Belastung der Haushalte und Sozialversicherungen. Nicht anders dachte und argumentierte die schwarz-rote Regierung.

Wie an einen Strohhalm klammern sie sich alle an die Hoffnung, dass bald die Konjunktur anspringe und dann alles wieder so werde wie zuvor in 60 Jahren Bundesrepublik. Man muß kein Wirtschaftsexperte sein, um skeptisch zu sein. Ökonomen haben vorgerechnet, dass das anvisierte Wachstum für einige Jahre stramme chinesische Raten von 7 Prozent betragen müßte, um überhaupt einen nennenswert schuldentilgenden Effekt erreichen zu können. Die gegenwärtige Politik grenzt angesichts solcher Zahlen an Illusionismus und ist eine Amokfahrt. Und von analytischen Köpfen wie dem Neomarxisten Robert Kurz wird denn auch die gegenwärtige Ruhe als Scheinerholung charakterisiert. Die Krise sei keine konjunkturelle, sondern eine strukturelle des Kapitalismus.

Zu den Schattenseiten unseres Wirtschaftssystems gehört die Okkupation des Denkens, etwa wenn die Lebensqualität mit der Anhäufung materieller Güter gleichgesetzt wird. Der Vermehrung materiellen Reichtums steht nämlich eine erschreckende Verarmung auf anderen Feldern gegenüber. Die Schattenseiten sind dem System strukturimmanent. Der durch die Zinsvergabe in Gang gesetzte Zwang zum Wachstum zwingt innerhalb der Betriebe zu ständigen Innovationen und Rationalisierungen. Das heißt:

- es muß immer mehr produziert und erwirtschaftet werden, um die Investitionskosten und bedrohlichen Zinsen abzubezahlen und zugleich einen eigenen Ertrag erwirtschaften zu können. Dadurch wachsen aber auch die Müllberge;

- es muß immer mehr Altes vernichtet werden, um für vermarktbares Neues Platz zu schaffen. Das kann man beispielsweise bei den Flächenabrissen chinesischer Altstädte sehen, die durch riesige Trabantenstädte ersetzt werden. Grundbesitzer, Architekten, Politiker und Bauspekulanten reichen sich die Hände;

- es müssen stets Arbeitnehmer wegrationalisiert werden, um die Produktionskosten zu verringern. Dadurch wächst aber auch das Heer derjenigen, die sich nicht mehr selbständig ernähren können.

- Das Neue ist die heilige Kuh. Neue Produkte schaffen den Wachstum, den der Kapitalismus braucht. Das Bedürfnis für dieses Neue mußn bei den möglichen Kunden erst geweckt werden. Die Werbeindustrie produziert Images von Waren, über deren Konsum man scheinbar „Anerkennung“ oder „Liebe“ erhalten würde, und verstopft mit Filmclips, Pop-Ups, Flugzetteln oder Großplakaten Augen und Ohren der Menschen.

Der Kapitalismus ist also wie ein immer heißer laufender Motor, den man nicht abstellen kann. Und dieser Motor verschlingt auch alles, was in den Jahrhunderten vor ihm an Tradition gewachsen ist, da nunmehr nur noch Preis und Ertrag zählen. Menschen werden über Kontinente verschoben, weil sie billiges Arbeitsmaterial darstellen (das wird dann werbetechnisch als „multikulturelle Bereicherung“ verkauft). Alte Baukunst wird durch moderne Standardware ersetzt.

Das war übrigens ja die Ursache des Siegeszuges der Bauhaus-Moderne. Sie war kostengünstig herstellbar, normierbar, global einsetzbar. Fernsehsender liefern der Jugend den letzten Schund, wenn dies nur den nötigen Profit verspricht. Der Motor dieser kapitalistischen Wirtschaft ist, bei aller materieller Erfolgsgeschichte, ein gewaltiges kulturelles Zerstörungswerk.

Alles ist diesem Wahn nach Wachstum, der Gier nach dem „Immer mehr“ unterworfen. Gleichwohl, alles hat ein Ende. Auch wenn der Kapitalismus suggeriert hat, er sei der ewige Endzustand der Geschichte, unterliegt auch er Verfallsprozessen. Und diese liegen gerade in der Überhitzung seiner Kredit- und Wachstumsspiralen.

Die Hoffnung auf Rettung durch die Impulse der neuen IT-Technologie seit den 1980er Jahren war trügerisch, da diese Innovation – anders als die Automobilbranche – erstmalig mehr Arbeitsplätze zum verschwinden brachte, als neue schaffte. Eine weitere, die Konjunktur nachhaltige belebende technische Innovation ist nicht in Sicht. Die Wirtschaftskrise wird also nicht mehr verschwinden, sondern uns fortan dauerhaft begleiten.

Wird der Kapitalismus überleben wollen, wird ihm langfristig wohl nur die Option bleiben, neuen Konsumbedarf zu schaffen. Die Konsumkraft der für den Warenverkehr geöffneten „zweiten“ und „dritten Welt“ wird kaum ausreichen, um dieses Dilemma zu verbessern. Der hiesige Staat wird sich zudem durch die Zerstörung der Sparvermögen seiner Mittelschichten zu entschulden versuchen, also mittels Inflation und eventueller Währungsreform.

Die Wirtschaft wird ohne die Zerstörung von Gütern also kaum wirklich starke Konsumanreize schaffen können. Dies aber würde in letzter Konsequenz heißen, daß wieder eine Situation geschaffen werden muß, die jener von 1945 nicht unähnlich wäre. Das heute noch unvorstellbare Bild eines Krieges, einschließlich massiver Zerstörungen, begleitet das schale Szenario jenes sich erneuernden Kapitalismus, der wie ein Phönix aus der Asche wieder auferstehen zu hofft. So könnten selbst asymetrische Bürgerkriegsszenarien von denjenigen, die heute von offenen Grenzen und gesteigerter Einwanderung billiger Arbeits- und Konsummigranten profitieren, mit Gelassenheit betrachtet werden, da sie später selbst daran noch zu verdienen hoffen.

00:24 Publié dans Actualité | Lien permanent | Commentaires (0) | Tags : économie, capitalisme, libéralisme, ploutocratie, allemagne, politique, politique internationale |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

jeudi, 15 octobre 2009

The Economic Recovery is an Illusion

The Economic Recovery is an Illusion The Bank for International Settlements (BIS) Warns of Future Crises By Andrew Gavin Marshall | |

| Global Research, October 3, 2009 | |

| War is Peace, Freedom is Slavery, Ignorance is Strength, and Debt is Recovery

In light of the ever-present and unyieldingly persistent exclamations of ‘an end’ to the recession, a ‘solution’ to the crisis, and a ‘recovery’ of the economy; we must remember that we are being told this by the very same people and institutions which told us, in years past, that there was ‘nothing to worry about,’ that ‘the fundamentals are fine,’ and that there was ‘no danger’ of an economic crisis.

Why do we continue to believe the same people that have, in both statements and choices, been nothing but wrong? Who should we believe and turn to for more accurate information and analysis? Perhaps a useful source would be those at the epicenter of the crisis, in the heart of the shadowy world of central banking, at the global banking regulator, and the “most prestigious financial institution in the world,” which accurately predicted the crisis thus far: The Bank for International Settlements (BIS). This would be a good place to start.

The economic crisis is anything but over, the “solutions” have been akin to putting a band-aid on an amputated arm. The Bank for International Settlements (BIS), the central bank to the world’s central banks, has warned and continues to warn against such misplaced hopes.

What is the Bank for International Settlements (BIS)?

The BIS emerged from the Young Committee set up in 1929, which was created to handle the settlements of German reparations payments outlined in the Versailles Treaty of 1919. The Committee was headed by Owen D. Young, President and CEO of General Electric, co-author of the 1924 Dawes Plan, member of the Board of Trustees of the Rockefeller Foundation and was Deputy Chairman of the Federal Reserve Bank of New York. As the main American delegate to the conference on German reparations, he was also accompanied by J.P. Morgan, Jr.[1] What emerged was the Young Plan for German reparations payments.

The Plan went into effect in 1930, following the stock market crash. Part of the Plan entailed the creation of an international settlement organization, which was formed in 1930, and known as the Bank for International Settlements (BIS). It was purportedly designed to facilitate and coordinate the reparations payments of Weimar Germany to the Allied powers. However, its secondary function, which is much more secretive, and much more important, was to act as “a coordinator of the operations of central banks around the world.” Described as “a bank for central banks,” the BIS “is a private institution with shareholders but it does operations for public agencies. Such operations are kept strictly confidential so that the public is usually unaware of most of the BIS operations.”[2]

The BIS was founded by “the central banks of Belgium, France, Germany, Italy, the Netherlands, Japan, and the United Kingdom along with three leading commercial banks from the United States, including J.P. Morgan & Company, First National Bank of New York, and First National Bank of Chicago. Each central bank subscribed to 16,000 shares and the three U.S. banks also subscribed to this same number of shares.” However, “Only central banks have voting power.”[3]

Central bank members have bi-monthly meetings at the BIS where they discuss a variety of issues. It should be noted that most “of the transactions carried out by the BIS on behalf of central banks require the utmost secrecy,”[4] which is likely why most people have not even heard of it. The BIS can offer central banks “confidentiality and secrecy which is higher than a triple-A rated bank.”[5]

The BIS was established “to remedy the decline of London as the world’s financial center by providing a mechanism by which a world with three chief financial centers in London, New York, and Paris could still operate as one.”[6] As Carroll Quigley explained:

[T]he powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basle, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations.[7]

The BIS, is, without a doubt, the most important, powerful, and secretive financial institution in the world. It’s warnings should not be taken lightly, as it would be the one institution in the world that would be privy to such information more than any other.

Derivatives Crisis Ahead

In September of 2009, the BIS reported that, “The global market for derivatives rebounded to $426 trillion in the second quarter as risk appetite returned, but the system remains unstable and prone to crises.” The BIS quarterly report said that derivatives rose 16% “mostly due to a surge in futures and options contracts on three-month interest rates.” The Chief Economist of the BIS warned that the derivatives market poses “major systemic risks” in the international financial sector, and that, “The danger is that regulators will again fail to see that big institutions have taken far more exposure than they can handle in shock conditions.” The economist added that, “The use of derivatives by hedge funds and the like can create large, hidden exposures.”[8]

The day after the report by the BIS was published, the former Chief Economist of the BIS, William White, warned that, “The world has not tackled the problems at the heart of the economic downturn and is likely to slip back into recession,” and he further “warned that government actions to help the economy in the short run may be sowing the seeds for future crises.” He was quoted as warning of entering a double-dip recession, “Are we going into a W[-shaped recession]? Almost certainly. Are we going into an L? I would not be in the slightest bit surprised.” He added, “The only thing that would really surprise me is a rapid and sustainable recovery from the position we’re in.”

An article in the Financial Times explained that White’s comments are not to be taken lightly, as apart from heading the economic department at the BIS from 1995 to 2008, he had, “repeatedly warned of dangerous imbalances in the global financial system as far back as 2003 and – breaking a great taboo in central banking circles at the time – he dared to challenge Alan Greenspan, then chairman of the Federal Reserve, over his policy of persistent cheap money.”

The Financial Times continued:

Worldwide, central banks have pumped thousands of billions of dollars of new money into the financial system over the past two years in an effort to prevent a depression. Meanwhile, governments have gone to similar extremes, taking on vast sums of debt to prop up industries from banking to car making.

White warned that, “These measures may already be inflating a bubble in asset prices, from equities to commodities,” and that, “there was a small risk that inflation would get out of control over the medium term.” In a speech given in Hong Kong, White explained that, “the underlying problems in the global economy, such as unsustainable trade imbalances between the US, Europe and Asia, had not been resolved.”[9]

On September 20, 2009, the Financial Times reported that the BIS, “the head of the body that oversees global banking regulation,” while at the G20 meeting, “issued a stern warning that the world cannot afford to slip into a ‘complacent’ assumption that the financial sector has rebounded for good,” and that, “Jaime Caruana, general manager of the Bank for International Settlements and a former governor of Spain’s central bank, said the market rebound should not be misinterpreted.”[10]

This follows warnings from the BIS over the summer of 2009, regarding misplaced hope over the stimulus packages organized by various governments around the world. In late June, the BIS warned that, “fiscal stimulus packages may provide no more than a temporary boost to growth, and be followed by an extended period of economic stagnation.”

An article in the Australian reported that, “The only international body to correctly predict the financial crisis ... has warned the biggest risk is that governments might be forced by world bond investors to abandon their stimulus packages, and instead slash spending while lifting taxes and interest rates,” as the annual report of the BIS “has for the past three years been warning of the dangers of a repeat of the depression.” Further, “Its latest annual report warned that countries such as Australia faced the possibility of a run on the currency, which would force interest rates to rise.” The BIS warned that, “a temporary respite may make it more difficult for authorities to take the actions that are necessary, if unpopular, to restore the health of the financial system, and may thus ultimately prolong the period of slow growth.”

Further, “At the same time, government guarantees and asset insurance have exposed taxpayers to potentially large losses,” and explaining how fiscal packages posed significant risks, it said that, “There is a danger that fiscal policy-makers will exhaust their debt capacity before finishing the costly job of repairing the financial system,” and that, “There is the definite possibility that stimulus programs will drive up real interest rates and inflation expectations.” Inflation “would intensify as the downturn abated,” and the BIS “expressed doubt about the bank rescue package adopted in the US.”[11]

The BIS further warned of inflation, saying that, “The big and justifiable worry is that, before it can be reversed, the dramatic easing in monetary policy will translate into growth in the broader monetary and credit aggregates.” That will “lead to inflation that feeds inflation expectations or it may fuel yet another asset-price bubble, sowing the seeds of the next financial boom-bust cycle.”[12] With the latest report on the derivatives bubble being created, it has become painfully clear that this is exactly what has happened: the creation of another asset-price bubble. The problem with bubbles is that they burst.

The Financial Times reported that William White, former Chief Economist at the BIS, also “argued that after two years of government support for the financial system, we now have a set of banks that are even bigger - and more dangerous - than ever before,” which also, “has been argued by Simon Johnson, former chief economist at the International Monetary Fund,” who “says that the finance industry has in effect captured the US government,” and pointedly stated: “recovery will fail unless we break the financial oligarchy that is blocking essential reform.”[13] [Emphasis added].

At the beginning of September 2009, central bankers met at the BIS, and it was reported that, “they had agreed on a package of measures to strengthen the regulation and supervision of the banking industry in the wake of the financial crisis,” and the chief of the European Central Bank was quoted as saying, “The agreements reached today among 27 major countries of the world are essential as they set the new standards for banking regulation and supervision at the global level.”[14]

Among the agreed measures, “lenders should raise the quality of their capital by including more stock,” and “Banks will also have to raise the amount and quality of the assets they keep in reserve and curb leverage.” One of the key decisions made at the Basel conference, which is named after the Basel Committee on Banking Supervision, set up under the BIS, was that, “banks will need to raise the quality of their so-called Tier 1 capital base, which measures a bank’s ability to absorb sudden losses,” meaning that, “The majority of such reserves should be common shares and retained earnings and the holdings will be fully disclosed.”[15]

In mid-September, the BIS said that, “Central banks must coordinate global supervision of derivatives clearinghouses and consider offering them access to emergency funds to limit systemic risk.” In other words, “Regulators are pushing for much of the $592 trillion market in over-the-counter derivatives trades to be moved to clearinghouses which act as the buyer to every seller and seller to every buyer, reducing the risk to the financial system from defaults.” The report released by the BIS asked if clearing houses “should have access to central bank credit facilities and, if so, when?”[16]

A Coming Crisis

The derivatives market represents a massive threat to the stability of the global economy. However, it is one among many threats, all of which are related and intertwined; one will set off another. The big elephant in the room is the major financial bubble created from the bailouts and “stimulus” packages worldwide. This money has been used by major banks to consolidate the economy; buying up smaller banks and absorbing the real economy; productive industry. The money has also gone into speculation, feeding the derivatives bubble and leading to a rise in stock markets, a completely illusory and manufactured occurrence. The bailouts have, in effect, fed the derivatives bubble to dangerous new levels as well as inflating the stock market to an unsustainable position.

However, a massive threat looms in the cost of the bailouts and so-called “stimulus” packages. The economic crisis was created as a result of low interest rates and easy money: high-risk loans were being made, money was invested in anything and everything, the housing market inflated, the commercial real estate market inflated, derivatives trade soared to the hundreds of trillions per year, speculation ran rampant and dominated the global financial system. Hedge funds were the willing facilitators of the derivatives trade, and the large banks were the major participants and holders.

At the same time, governments spent money loosely, specifically the United States, paying for multi-trillion dollar wars and defense budgets, printing money out of thin air, courtesy of the global central banking system. All the money that was produced, in turn, produced debt. By 2007, the total debt – domestic, commercial and consumer debt – of the United States stood at a shocking $51 trillion.[17]

As if this debt burden was not enough, considering it would be impossible to ever pay back, the past two years has seen the most expansive and rapid debt expansion ever seen in world history – in the form of stimulus and bailout packages around the world. In July of 2009, it was reported that, “U.S. taxpayers may be on the hook for as much as $23.7 trillion to bolster the economy and bail out financial companies, said Neil Barofsky, special inspector general for the Treasury’s Troubled Asset Relief Program.”[18]

Bilderberg Plan in Action?

In May of 2009, I wrote an article covering the Bilderberg meeting of 2009, a highly secretive meeting of major elites from Europe and North America, who meet once a year behind closed doors. Bilderberg acts as an informal international think tank, and they do not release any information, so reports from the meetings are leaked and the sources cannot be verified. However, the information provided by Bilderberg trackers and journalists Daniel Estulin and Jim Tucker have proven surprisingly accurate in the past.

In May, the information that leaked from the meetings regarded the main topic of conversation being, unsurprisingly, the economic crisis. The big question was to undertake “Either a prolonged, agonizing depression that dooms the world to decades of stagnation, decline and poverty ... or an intense-but-shorter depression that paves the way for a new sustainable economic world order, with less sovereignty but more efficiency.”

Important to note, was that one major point on the agenda was to “continue to deceive millions of savers and investors who believe the hype about the supposed up-turn in the economy. They are about to be set up for massive losses and searing financial pain in the months ahead.”

Estulin reported on a leaked report he claimed to have received following the meeting, which reported that there were large disagreements among the participants, as “The hardliners are for dramatic decline and a severe, short-term depression, but there are those who think that things have gone too far and that the fallout from the global economic cataclysm cannot be accurately calculated.” However, the consensus view was that the recession would get worse, and that recovery would be “relatively slow and protracted,” and to look for these terms in the press over the next weeks and months. Sure enough, these terms have appeared ad infinitum in the global media.

Estulin further reported, “that some leading European bankers faced with the specter of their own financial mortality are extremely concerned, calling this high wire act ‘unsustainable,’ and saying that US budget and trade deficits could result in the demise of the dollar.” One Bilderberger said that, “the banks themselves don't know the answer to when (the bottom will be hit).” Everyone appeared to agree, “that the level of capital needed for the American banks may be considerably higher than the US government suggested through their recent stress tests.” Further, “someone from the IMF pointed out that its own study on historical recessions suggests that the US is only a third of the way through this current one; therefore economies expecting to recover with resurgence in demand from the US will have a long wait.” One attendee stated that, “Equity losses in 2008 were worse than those of 1929,” and that, “The next phase of the economic decline will also be worse than the '30s, mostly because the US economy carries about $20 trillion of excess debt. Until that debt is eliminated, the idea of a healthy boom is a mirage.”[19]

Could the general perception of an economy in recovery be the manifestation of the Bilderberg plan in action? Well, to provide insight into attempting to answer that question, we must review who some of the key participants at the conference were.

Central Bankers

Many central bankers were present, as per usual. Among them, were the Governor of the National Bank of Greece, Governor of the Bank of Italy, President of the European Investment Bank; James Wolfensohn, former President of the World Bank; Nout Wellink, President of the Central Bank of the Netherlands and is on the board of the Bank for International Settlements (BIS); Jean-Claude Trichet, the President of the European Central Bank was also present; the Vice Governor of the National Bank of Belgium; and a member of the Board of the Executive Directors of the Central Bank of Austria.

Finance Ministers and Media

Finance Ministers and officials also attended from many different countries. Among the countries with representatives present from the financial department were Finland, France, Great Britain, Italy, Greece, Portugal, and Spain. There were also many representatives present from major media enterprises around the world. These include the publisher and editor of Der Standard in Austria; the Chairman and CEO of the Washington Post Company; the Editor-in-Chief of the Economist; the Deputy Editor of Die Zeit in Germany; the CEO and Editor-in-Chief of Le Nouvel Observateur in France; the Associate Editor and Chief Economics Commentator of the Financial Times; as well as the Business Correspondent and the Business Editor of the Economist. So, these are some of the major financial publications in the world present at this meeting. Naturally, they have a large influence on public perceptions of the economy.

Bankers

Also of importance to note is the attendance of private bankers at the meeting, for it is the major international banks that own the shares of the world’s central banks, which in turn, control the shares of the Bank for International Settlements (BIS). Among the banks and financial companies represented at the meeting were Deutsche Bank AG, ING, Lazard Freres & Co., Morgan Stanley International, Goldman Sachs, Royal Bank of Scotland, and of importance to note is David Rockefeller,[20] former Chairman and CEO of Chase Manhattan (now J.P. Morgan Chase), who can arguably be referred to as the current reigning ‘King of Capitalism.’

The Obama Administration

Heavy representation at the Bilderberg meeting also came from members of the Obama administration who are tasked with resolving the economic crisis. Among them were Timothy Geithner, the US Treasury Secretary and former President of the Federal Reserve Bank of New York; Lawrence Summers, Director of the White House's National Economic Council, former Treasury Secretary in the Clinton administration, former President of Harvard University, and former Chief Economist of the World Bank; Paul Volcker, former Governor of the Federal Reserve System and Chair of Obama’s Economic Recovery Advisory Board; Robert Zoellick, former Chairman of Goldman Sachs and current President of the World Bank.[21]

Unconfirmed were reports of the Fed Chairman, Ben Bernanke being present. However, if the history and precedent of Bilderberg meetings is anything to go by, both the Chairman of the Federal Reserve and the President of the Federal Reserve Bank of New York are always present, so it would indeed be surprising if they were not present at the 2009 meeting. I contacted the New York Fed to ask if the President attended any organization or group meetings in Greece over the scheduled dates that Bilderberg met, and the response told me to ask the particular organization for a list of attendees. While not confirming his presence, they also did not deny it. However, it is still unverified.

Naturally, all of these key players to wield enough influence to alter public opinion and perception of the economic crisis. They also have the most to gain from it. However, whatever image they construct, it remains just that; an image. The illusion will tear apart soon enough, and the world will come to realize that the crisis we have gone through thus far is merely the introductory chapter to the economic crisis as it will be written in history books.

Conclusion

The warnings from the Bank for International Settlements (BIS) and its former Chief Economist, William White, must not be taken lightly. Both the warnings of the BIS and William White in the past have gone unheralded and have been proven accurate with time. Do not allow the media-driven hope of ‘economic recovery’ sideline the ‘economic reality.’ Though it can be depressing to acknowledge; it is a far greater thing to be aware of the ground on which you tread, even if it is strewn with dangers; than to be ignorant and run recklessly through a minefield. Ignorance is not bliss; ignorance is delayed catastrophe.

A doctor must first properly identify and diagnose the problem before he can offer any sort of prescription as a solution. If the diagnosis is inaccurate, the prescription won’t work, and could in fact, make things worse. The global economy has a large cancer in it: it has been properly diagnosed by some, yet the prescription it was given was to cure a cough. The economic tumor has been identified; the question is: do we accept this and try to address it, or do we pretend that the cough prescription will cure it? What do you think gives a stronger chance of survival? Now try accepting the idea that ‘ignorance is bliss.’

As Gandhi said, “There is no god higher than truth.” For an overview of the coming financial crises, see: "Entering the Greatest Depression in History: More Bubbles Waiting to Burst," Global Research, August 7, 2009.

[1] Time, HEROES: Man-of-the-Year. Time Magazine: Jan 6, 1930: http://www.time.com/time/magazine/article/0,9171,738364-1,00.html

[2] James Calvin Baker, The Bank for International Settlements: evolution and evaluation. Greenwood Publishing Group, 2002: page 2

[3] James Calvin Baker, The Bank for International Settlements: evolution and evaluation. Greenwood Publishing Group, 2002: page 6

[4] James Calvin Baker, The Bank for International Settlements: evolution and evaluation. Greenwood Publishing Group, 2002: page 148

[5] James Calvin Baker, The Bank for International Settlements: evolution and evaluation. Greenwood Publishing Group, 2002: page 149

[6] Carroll Quigley, Tragedy and Hope: A History of the World in Our Time (New York: Macmillan Company, 1966), 324-325

[7] Carroll Quigley, Tragedy and Hope: A History of the World in Our Time (New York: Macmillan Company, 1966), 324

[8] Ambrose Evans-Pritchard, Derivatives still pose huge risk, says BIS. The Telegraph: September 13, 2009: http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/6184496/Derivatives-still-pose-huge-risk-says-BIS.html

[9] Robert Cookson and Sundeep Tucker, Economist warns of double-dip recession. The Financial Times: September 14, 2009: http://www.ft.com/cms/s/0/e6dd31f0-a133-11de-a88d-00144feabdc0.html

[10] Patrick Jenkins, BIS head worried by complacency. The Financial Times: September 20, 2009: http://www.ft.com/cms/s/0/a7a04972-a60c-11de-8c92-00144feabdc0.html

[11] David Uren. Bank for International Settlements warning over stimulus benefits. The Australian: June 30, 2009: http://www.theaustralian.news.com.au/story/0,,25710566-601,00.html

[12] Simone Meier, BIS Sees Risk Central Banks Will Raise Interest Rates Too Late. Bloomberg: June 29, 2009: http://www.bloomberg.com/apps/news?pid=20601068&sid=aOnSy9jXFKaY

[13] Robert Cookson and Victor Mallet, Societal soul-searching casts shadow over big banks. The Financial Times: September 18, 2009: http://www.ft.com/cms/s/0/7721033c-a3ea-11de-9fed-00144feabdc0.html

[14] AFP, Top central banks agree to tougher bank regulation: BIS. AFP: September 6, 2009: http://www.google.com/hostednews/afp/article/ALeqM5h8G0ShkY-AdH3TNzKJEetGuScPiQ

[15] Simon Kennedy, Basel Group Agrees on Bank Standards to Avoid Repeat of Crisis. Bloomberg: September 7, 2009: http://www.bloomberg.com/apps/news?pid=20601087&sid=aETt8NZiLP38

[16] Abigail Moses, Central Banks Must Agree Global Clearing Supervision, BIS Says. Bloomberg: September 14, 2009: http://www.bloomberg.com/apps/news?pid=20601087&sid=a5C6ARW_tSW0

[17] FIABIC, US home prices the most vital indicator for turnaround. FIABIC Asia Pacific: January 19, 2009: http://www.fiabci-asiapacific.com/index.php?option=com_content&task=view&id=133&Itemid=41

Alexander Green, The National Debt: The Biggest Threat to Your Financial Future. Investment U: August 25, 2008: http://www.investmentu.com/IUEL/2008/August/the-national-debt.html

John Bellamy Foster and Fred Magdoff, Financial Implosion and Stagnation. Global Research: May 20, 2009: http://www.globalresearch.ca/index.php?context=va&aid=13692

[18] Dawn Kopecki and Catherine Dodge, U.S. Rescue May Reach $23.7 Trillion, Barofsky Says (Update3). Bloomberg: July 20, 2009: http://www.bloomberg.com/apps/news?pid=20601087&sid=aY0tX8UysIaM

[19] Andrew Gavin Marshall, The Bilderberg Plan for 2009: Remaking the Global Political Economy. Global Research: May 26, 2009: http://www.globalresearch.ca/index.php?aid=13738&context=va

[20] Maja Banck-Polderman, Official List of Participants for the 2009 Bilderberg Meeting. Public Intelligence: July 26, 2009: http://www.publicintelligence.net/official-list-of-participants-for-the-2009-bilderberg-meeting/

[21] Andrew Gavin Marshall, The Bilderberg Plan for 2009: Remaking the Global Political Economy. Global Research: May 26, 2009: http://www.globalresearch.ca/index.php?aid=13738&context=va

Andrew Gavin Marshall is a Research Associate with the Centre for Research on Globalization (CRG). He is currently studying Political Economy and History at Simon Fraser University. | |

| | |

| | |

00:30 Publié dans Economie | Lien permanent | Commentaires (0) | Tags : économie, globalisation, crise, finances, ploutocratie |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

mercredi, 22 avril 2009

Le couple Obama a déclaré deux millions d'euros de revenus en 2008

Ploutocratie : le couple Obama a déclaré deux millions d’euros de revenus en 2008

20/04/2009 –19h00

20/04/2009 –19h00

WASHINGTON (NOVOpress) – Selon un communiqué de la Maison Blanche de la semaine dernière, le président américain et son épouse ont gagné 2,65 millions de dollars en 2008 soit environ deux millions d’euros.

L’essentiel de cette somme est dû aux droits d’auteur que le messie métis de l’Amérique perçoit pour ses livres Les Rêves de Mon Père et L’Audace d’Espérer. Le premier est resté 142 semaines dans la liste des best-sellers du New York Times et le second, 67 semaines. Les droits d’auteur du nouveau Président américain se sont élevés à 2,5 millions de dollars (soit un peu moins de deux millions d’euros) en 2008 comme en 2007. En tant que sénateur de l’Illinois, Barack Obama a également touché une indemnité parlementaire de139 204 dollars (soit 105 454 euros).

Michelle Obama, Avocate de profession, a perçu pour sa part 62 709 dollars (47 492 euros) de salaire des hôpitaux de l’Université de Chicago, dont elle était l’une des directrices à mi-temps avant de devenir la première dame des Etats-Unis.

A titre de comparaison, le revenu médian des ménages américains - qui partage exactement en deux la population, une moitié disposant d’un revenu supérieur, l’autre moitié d’un revenu inférieur à celui-ci - est d’environ 38 000 euros par an. Obama s’était présenté durant la campagne comme le candidat des minorités ethniques, des pauvres et du changement. A l’instar de ses prédécesseurs, le nouveau président américain reste avant tout celui de l’argent.

[cc] Novopress.info, 2009, Dépêches libres de copie et diffusion sous réserve de mention de la source d’origine

[http://fr.novopress.info]

00:40 Publié dans Actualité | Lien permanent | Commentaires (0) | Tags : obama, etats-unis, amérique, ploutocratie, argent, crise, élections américaines |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

mardi, 09 décembre 2008

Le krach du libéralisme

EN KIOSQUE CETTE SEMAINE

08:02 Publié dans Revue | Lien permanent | Commentaires (0) | Tags : libéralisme, crise, finances, usure, usurocratie, ploutocratie, théorie politique |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

vendredi, 25 juillet 2008

Tolkien over financierders

Tolkien over financierders

“De ware vergelijking is: “democratie” = regering door wereldfinancierders… Het hoofdkenmerk van moderne regeringen is dat wij niet weten wie regeert, zowel de facto als de jure. Wij zien de politicus en niet zijn beschermheer; nog minder de beschermheer van de beschermheer of wat het belangrijkste van allemaal is: de bankier van de beschermheer. Getroond boven allen, op een manier zonder gelijke in heel het verleden, is de versluierde profeet van de financiën. Hij beheerst alle levende mensen door een soort van magie en levert orakels in een taal niet begrepen door de mensen”.

J.R.R. Tolkien,

Candour Magazine, 13 July 1956, p. 12

00:10 Publié dans Littérature | Lien permanent | Commentaires (0) | Tags : littérature, angleterre, lettres, citation, economie, finances, ploutocratie |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

.JPG)