vendredi, 25 décembre 2015

Un système financier propre à l'Eglise orthodoxe russe?

Un système financier propre à l'Eglise orthodoxe russe?

par Jean Paul Baquiast

Ex: http://www.europesolidaire.eu

Son conseiller juridique Dmitri Lubomudrov avait déclaré à l'époque qu'au nom de la Russie toute entière, l'Eglise orthodoxe voulait échapper à la domination du système financier occidental, en instaurant son propre système. Celui-ci reposerait, comme celui de la banque dite islamique s'étant auto-instaurée parallèlement dans les pays musulmans pour réinvestir les pétro-dollars, sur la moralité orthodoxe et les contributions que peuvent y trouver les hommes d'affaires en quête de sécurité. Parmi ses caractéristiques, il y aurait l'émission de crédit sans intérêt et l'interdiction des investissements dans les casinos ou dans des activités allant à l'encontre des valeurs morales de l'Eglise.

Il faut rappeler qu'en Russie, celle-ci est de plus en plus présente et recrute un nombre croissant de fidèles. On peut les estimer à 70 % de la population, les athées proclamés ne dépassant pas les 10%, les musulmans pratiquant étant estimés à 20%. De plus, comme cela n'a échappé à personne, Vladimir Poutine et ceux qui se rassemblent derrière lui pour redresser la Russie, n'hésitent jamais à faire appel aux valeurs de l'Eglise orthodoxe pour cimenter l'identité de la société russe. Il n'hésite pas lui même à manifester des signes de pitié. Il est vrai que ses homologues aux Etats-Unis ont toujours fait de même concernant leur propre religion. En Europe et notamment en France, le principe de laïcité interdit de telles invocations.

La Chambre de commerce et d'industrie russe

Tout récemment, le projet d'un système bancaire orthodoxe a reçu le soutien de Sergei Katyrin, à la tête de la Chambre de commerce et d'industrie russe. Il s'est dit prêt à en discuter de façon plus approfondie. L'initiative visant à mettre en place des prêts sans intérêts présente pour lui une possibilité de réduire la dépendance de la Russie au système bancaire américano-européen, machine de guerre, a-t-il dit pour obliger la Russie à choisir le camp occidental.

Tout comme les modèles bancaires islamiques ont interdit l'usure, le système financier orthodoxe ne permettrait pas d'intérêts sur ses prêts. Les participants à ces systèmes partagent les risques, les profits et les pertes. Tout comportement spéculatif est interdit, ainsi que comme indiqué ci-dessus, les investissements dans le jeu, la drogue et d'autres entreprises qui ne respectent pas les valeurs chrétiennes orthodoxes.

Il conviendrait pour cela de créer une nouvelle banque réservant ses crédits aux opérations à faible risque, de façon à ne pas mettre en danger les fonds qui lui seraient confiés par les institutions et les épargnants privés. Cette banque viserait en priorité le financement d'opérations dans le secteur dit « réel » de l'économie, de préférence aux investissements financiers dits virtuels. Les investissements recommandés par le gouvernement bénéficieraient en premier lieu de ces financements.

Il s'agirait dans une certaine mesure de la mise en place d'une banque de dépôts finançant des dépenses constructives, se distinguant d'une banque spéculative à risque intervenant sur le marché spéculatif international. Ainsi serait recréée la distinction entre banques de dépôts et banques d'investissements à risque, que le système bancaire et financier international s'est toujours refusé à remettre en vigueur depuis l'abrogation aux Etats-Unis en 1999 du Glass-Stegall Act de 1933 imposant cette distinction.

Un certain scepticisme

Malgré la sympathie qu'elle recueille, la proposition de Finance orthodoxe éveille en Russie même beaucoup de réserves. Ne donnerait-elle pas un poids excessif à cette Eglise, au risque d'en faire le moment venu un acteur essentiel pour s'opposer à Vladimir Poutine et aux modernistes. Ceci d'autant plus qu'interpréter au regard de la morale de l'Eglise orthodoxe tous les investissements scientifiques et technologies futurs de la Russie compromettrait le rôle que celle-ci veut se donner au sein du Brics et de l'Organisation de Shanghai. Par ailleurs, le financement de grands projets par les institutions financières actuellement en cours de mise en place, notamment par l'AIIB, pourrait être jugé « non-orthodoxe ». L'exemple du détournement au profit des mouvements terroristes de beaucoup d'investissements financés par la Banque islamiste n'a rien de rassurant.

La volonté d'échapper à la tyrannie de Wall Street et à la domination du monde par les intérêts financiers transnationaux, si elle était véritablement assumée par les autorités russes, supposerait cependant que des structures bancaires et financières nouvelles soient mise en place. La tentative actuelle de créer un réseau interbancaire alternatif à Swift dominé par les intérêts anglo-saxon en fournit un exemple. Mais pour cela il faut ne pas se limiter à la seule Russie, mais intéresser un grand nombre de nations, non seulement celles du Brics mais d'autres qui dans le monde veulent s'affranchir de la domination américaine.

Ce projet pourrait alors en cas de succès intéresser un certain nombre de pays européens voulant échapper au malthusianisme imposé par l'euro ou l'Union européenne afin de retrouver un minimum de souveraineté. Nous avons ici même plusieurs fois proposé à l'initiative d'un de nos experts le projet d'un fonds européen d'investissements stratégiques capables de faire appel à l'épargne européenne sous forme d'Obligations à Durée Indéterminée. Un tel projet pourrait certainement converger avec des initiatives russes analogues. Mais en Europe la référence au Patriarcat de Moscou et de toute la Russie, selon le nom qu'il se donne, pourrait inquiéter beaucoup de petits et moyens épargnants dont les valeurs morales ne seraient pas pour autant discutables au regard d'une conception plus universelle de ce que pourrait être la morale.

00:05 Publié dans Actualité, Affaires européennes, Economie | Lien permanent | Commentaires (0) | Tags : actualité, politique internationale, russie, europe, affaires européennes, système bancaire, banque, finances, banque et finances, église orthodoxe, orthodoxie |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

dimanche, 09 novembre 2014

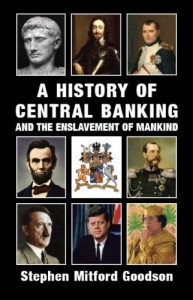

The Works of Stephen Mitford Goodson

Central Banking & Human Bondage: The Works of Stephen Mitford Goodson

By Kerry Bolton

Ex: http://www.counter-currents.com

Stephen Mitford Goodson

A History of Central Banking and the Enslavement of Mankind [2]

London: Black House Publishing, 2014

Stephen Mitford Goodson

Inside the South African Reserve Bank: Its Origins and Secrets Exposed [3]

London: Black House Publishing, 2014

Originally intended as one book, Black House Publishing has brought out two volumes that, while of course companions, are self-contained.

Originally intended as one book, Black House Publishing has brought out two volumes that, while of course companions, are self-contained.

Immediately the perceptive reader will be aware of several promising features of these books: The author’s middle name is Mitford, indicating the likelihood of a propensity towards rebelliousness.[1] Next, the author’s dedication of A History of Central Banking to Knut Hamsun, “a beacon of light and hope of the natural world order;” the great Norwegian novelist being a man of honor who refused to bow before Talmudic vengeance upon the defeated of World War II. The next promising feature is a quote from Ezra Pound (a figure akin to Hamsun for his having fought the same malignant forces, defending the same heroic ideals, and having undergone great persecutions in the post-war era) which sets the tone for the book: “And you will never understand American history or the history of the Occident during the past 2000 years unless you look at one or two problems; namely, sheenies and usury. One or the other, or both. I should say both.”[2]

Another interesting feature that immediately faces the reader is that the lengthy preface is written by Prince Mangosuthu Buthelezi, Member of Parliament and long-time leader of the Inkatha Freedom Party. While Prince Buthelezi begins by stating that he “does not endorse the viewpoints” expressed in the book, he also points out that the book is “controversial” and will “engender strong reaction.” The remarks of caution by Buthelezi are presumably necessitated by Goodson, like his Mitford relatives, insisting on documenting certain heresies pertaining to the influence of Jews on politics and finance, and on the achievements of Axis states in overthrowing shylockcracy.

Despite opening with that qualification, Buthelezi nonetheless proceeds to support Goodson’s views on central baking and usury as the main cause of “profound and inhumane differences” within nations throughout the world. Buthelezi, declares himself an enemy of that system: “For this reason, for several years, my Party and I have argued that South Africa should reform its central banking and monetary system, even if that means placing our country out of step with iniquitous world standards.” Since that is the case, one suspects that Buthelezi also realizes that the resistance of the Axis states to just this system might have been the real cause of their placing themselves “out of step with iniquitous world standards,” which Goodson subsequently explains. The prince writes: “This work provides not only a broad sweep of the history of economics over almost three millennia, but insights into how the problems of usury have been confounding and enslaving mankind since civilized existence first began.”

Goodson’s book is unique in this genre in several major ways: he traces the course of usury through history over thousands of years; something that has not usually been attempted since one of Ezra Pound’s favorite books, Brooks Adams’ Law of Civilization and Decay was published over a century ago.[3] Goodson also provides both a history of the usurers and those who opposed usury, plus technicalities on the finance system and how it can be fixed.

Goodson’s book is unique in this genre in several major ways: he traces the course of usury through history over thousands of years; something that has not usually been attempted since one of Ezra Pound’s favorite books, Brooks Adams’ Law of Civilization and Decay was published over a century ago.[3] Goodson also provides both a history of the usurers and those who opposed usury, plus technicalities on the finance system and how it can be fixed.

Goodson goes back to ancient Rome in seeking early examples of financial systems that have a bearing on the world today. He quotes Aristotle, from Politics, on what some would call the Traditionalist attitude[4] to such things but which are today called “respectable businessmen” and “good business practice”: “Men called bankers we shall hate, for they enrich themselves while doing nothing.” Aristotle thereby sums up the entirety of the case against orthodox banking. Goodson traces systems used in Rome such as the use of bronze pieces that were issued by the Roman state for the transaction of commerce, usury-free, an early example of fiat money; not to be confused with the present-day system of issuing fiat money via private banks, who receive their slice of usury, allowing this perverted “fiat money” to be condemned when it does not work.[5] Goodson draws on statistics to show that this was an era of great wealth and progress, at a time also when the Roman leaders lived by the austerity and honor of what it truly was to be “Roman.”

The system fell to ruin when Rome replaced these bronze ingots with silver, and the whole character of Rome was degraded. In other words, moral rot followed a change in banking. Usurers, including many Jews who had flocked to Rome during its epoch of decay, charged high interest on loans and destitution became widespread. As has often been the case in history, right up to our modern era, a heroic figure would arise to set matters aright, and this took the form of Julius Caesar, who knew fully of the situation. He issued cheap metal coins, and interest was heavily regulated. Goodson lists the measures undertaken in the socio-economic realm by Caesar, which are incredible; perhaps not to be repeated on such a scale until Mussolini, Hitler, and Michael Joseph Savage.[6] After Caesar’s death, Rome adopted the gold standard, and this was to have major negative consequences. It is an important example of the role “money power,” as we might call it, has played in the corruption and collapse of civilizations, the causes too often neglected by the Right which assigns this to the role of race in reductionist terms.[7]

Goodson begins the monetary history of England with King Offa of Mercia, during the 8th century, where again silver minted coins were used, and the pagan outlawing of usury was reintroduced. Under King Alfred the property of usurers was forfeited, while under Edward the Confessor usurers were declared outlaws. The rot set in when Jews arrived with the defeat of Harold II by William the conqueror in 1066, and these Jews were given privileged positions as usurers by William. England was ravished with debt, which spared nobody, either nobleman or workman. In 1215 the Magna Carta was forced on King John by his noblemen, the most important reason being to deal with usury.

During the Middle Ages usury was again abolished, and “tally sticks” were used. These were kept in use for 700 years, to some degree or other. Goodson records the system in some detail, and despite what we are told about the Middle Ages, the populace lived well, something that has been detailed by William Cobbett, in comparing the conditions of workers of Medieval times to those of the Industrial Revolution.[8] As in Rome, history repeated itself, with a series of ups and downs for the usurers over the centuries, and of course, as we now know, their eventual triumph, in this instance ushered in by the victory of Cromwell and the Puritan Revolution, shortly followed by the creation of the Bank of England, a privately owned consortium based on the Dutch model.[9] Goodson mentions that when the Bill that included the enacting of the Bank of England was passed, there were only 42 members of the House present, and all were Whigs; the Tories opposed the Bill. This is a further indication of my contention that the “true Right” is inherently anti-capitalist, while the Left, as Spengler pointed out, always acts in the interests of the “money party.”[10] From then on a pattern emerged, writes Goodson,

of attacking and enforcing the bankers’ system of usury [that] has been deployed widely in the modern era and includes the defeats of Imperial Russia in World War I, Germany, Italy and Japan in World War II and most recently Libya in 2011. These were all countries which had state banking systems, which distributed the wealth of their respective nations on an equitable basis and provided their populations with a standard of living far superior to that of their rivals and contemporaries.

Goodson points out that although the Labour Government nationalized the Bank of England in 1946 (i.e., over a decade after the New Zealand Labour Government had nationalized that country’s Reserve Bank in 1935, which had originally been created on the urging of the Bank of England’s globe-trotting adviser Sir Otto Niemeyer) it was mere window dressing as the Bank of England, like other “nationalized ” Reserve Banks, including New Zealand’s, remains within the global usury system, and they merely serve as conduits for borrowing from private international banks. What could be added is that when the New Zealand Labour Government nationalized the Reserve Bank, albeit at considerable public pressure to fulfill its election promises on state banking, led by maverick Labour MP and one-armed war veteran John A. Lee, its one great but enduing act was to issue 1% state credit for the iconic state housing project. This not only provided durable houses on quarter acre sections at low cost, but also solved, through this project of public works, 70% of the country’s unemployment during the midst of the world depression.[11]

Citing Harvard historian Carroll Quigley, Goodson shows that these central banks became part of a vast interlocking system of international finance, which has done nothing but expand ever since.

Other revolts against the banking system have included the American Colonies which financed their war against Britain with its own state money, as did both the Union and the Confederate states during the Civil War. Again a series of ups and downs followed as the usurers and their opponents vied for the enacting of their respective plans for banking, until when in 1913 the conflict was resolved with the Reserve Bank Act, passed again behind the façade that it would be a state bank that would bring “order” to finance, after three years of planning by the international bankers and their followers in politics.

Russia provides another example of a state that had an independent banking system, and is of particular interest insofar as – like the Axis states subsequently – the Czar has been pilloried as a tyrant whose overthrow was the result of popular revolution: a game plan which has been unfolding again in our own time over the past several decades via the so-called “colour revolutions” and “Arab Spring”, at the behest of the same types of people who instigated the “Russian” revolutions in 1917, and for the same reason, and prior to that the Cromwellian revolution and the French Revolution. (I would also add the “revolution from above” wrought by Henry VIII, which prominently involved another scabrous Cromwell).

Goodson states that after the defeat of Napoleon, Nathan Mayer Rothschild was active in pushing for a banking system that would secure the control of Europe. Czar Alexander I rejected any such plans and instead created a new Holy Alliance between Russia, Prussia, and Austria, who were to be pushed into cataclysmic conflict a few generations later. What was created in 1860 was a Russian state bank that served the people well for decades, with cheap loans, including low interest land loans for farmers, by the turn of the century most land being owned by the people who worked it. Taxes and debt were the lowest in Europe, and social and labour legislation among the best.

Goodson points out that the Bolsheviks brought this happy state to destruction. The details of this and the welcome international finance accorded the March 1917 Revolution, and bankers likewise supporting the Bolsheviks are documented in this reviewer’s books Revolution from Above[12] and The Banking Swindle. I will add here that much of the negative portrayal of the Czars, which continues to the present, was the result of American journalist George Kennan’s one-man propaganda offensive against Russia, Kennan being subsidised by Jacob Schiff of Kuhn, Loeb & Co., who also provided the wherewithal for Kennan to indoctrinate – according to Kennan – 52,000 Russian Prisoners of War in the aftermath of the Russo-Japanese War of 1904-1905, who returned to Russia to provide a revolutionary cadre that eventually overthrew the Czar.[13]

Inside the South African Reserve Bank: Its Origins and Secrets Exposed, features Goodson’s account of the way he was forced to resign prematurely before his term expired – albeit by only a short time – as a director of the South African Reserve Bank. Goodson, has an insider’s knowledge on the workings of debt-finance and reserve banks, and he is also the leader of the Abolition of Income Tax and Usury Party,[14] and has long been an economic consultant. It is this book that has apparently been the subject of threatened legal action from the South African state, which is very much interested in keeping Goodson mute as to his first-hand knowledge of corruption in the financial sector.

Goodson shows that South Africa was the first state after World War I to succumb to machinations in the creation of a central bank. This he places on the shoulders of General Smuts, Minister of Finance despite his lack of background in finance.[15] Like Senator Aldrich, whose so-called “Aldrich Plan” was enacted in 1913 to create the US Reserve Bank in 1914, Aldrich merely being the voice in Senate for Schiff, the Warburgs, Rockefellers, J. P. Morgan et al., the Smuts plan for a reserve bank was initiated and devised by his friend, the banker Sir Henry Strakosch, whose plan followed that of the US Federal Reserve Bank. The commission that was established from all Parliamentary parties provided strong criticism of the plan and expressed concern as to why it was being (like the “Aldrich Plan”) rushed through without proper debate. Colonel Creswell of the SA Labour Party proposed a state bank. The Parliamentary opposition to the Strakosch plan, and call for a state bank by the Labour Party, is of particular interest, and Goodson provides detail of the Parliamentary speeches.[16] In 1920 Parliament voted in favor of the Strakosch plan, while all 19 Labour members and three Nationalist members voting against. General Hertzog of the National Party had wanted the matter fully investigated over the course of two years, but was brushed aside. Strakosch was also instrumental in establishing the Reserve Bank of India in 1935. His role seems similar to that of Sir Otto Niemeyer of the Bank of England who at that time went about the British Commonwealth pushing for central banks to be created with private stockholders.

Furthermore, Strakosch paid the debts of Winston Churchill and from that moment the history of the world would embark on a tragic course: a world war in the service of international finance that would destroy the British and all other European empires, to be replaced by a money empire, while Roosevelt laid down the post-war conditions to the hapless Churchill for the dismantling of the British Empire.[17]

Goodson traces the origins of the Great Depression as an example of credit manipulation, and profiles those who sought an alternative: C. H. Douglas of social credit. Professor Irving Fisher. and Gottfried Feder, Germany’s primary banking reformer campaigner.[18] The innovative reforms undertaken by the Nazis were undermined by Hjalmar Schacht, president of the Reichsbank, an intimate of the international banking fraternity who was to be spared the fate of other high state officials at Nuremberg due to his connections, including particularly his friendship with Montague Norman, Governor of the Bank of England.

In 1939 Schacht issued an ultimatum to Hitler intended to revert Germany’s economy back to the old system, and was sacked. While the Hitler regime has been criticized for sidelining idealists such as Feder and even of serving international finance and not fully implementing its “socialistic” program, in fact, much was undertaken, and Goodson alludes to the “Schacht Plan” being replaced finally and decisively by the “Feder Plan” in 1939. Goodson contends that war was imposed on Hitler for the same reason as that faced by Napoleon, with Poland in this case as the bankers’ cat’s-paw. In one of many instances where Goodson places the banking system in the wider historical context, he relates what would now be called “ethnic cleansing” that was undertaken by the Polish authorities against ethnic Germans in Poland. Goodson places the German ethnic causalities in Poland at 58,000, culminating in the Bromberg Massacre of September 1939, in which 5,500 German ethnics were killed. Hitler’s peace plan was summarily rejected by the Polish Government due to the interference of Britain in guaranteeing Poland’s security.

Goodson proceeds to outline the many socio-economic achievements of the Hitler regime, such a low-interest loans for housing and the barter system that saw Germany capturing markets from Europe to South America, and undermining the system of international finance around the world, the rise in income, the great public works while, persistent claims to the contrary, expenditure on arms was relatively low.

While Germany flourished in the midst of a world depression, Fascist Italy had already embarked on a similar course a decade previously, with giant public works, and gradually adopted state banking. Japan, which readers might be surprised to learn, had since the 1920s had been widely attracted to the social credit theory of C. H. Douglas, followed such policies from 1932, and completed its reforms in 1942, based on German banking legislation. This established Japan as a great economic power and in 1940 she announced the Grater East Asia Co-Prosperity Sphere, which threatened the global economic system by creating an autarkic trading bloc. The pretext for action against Japan, Goodson states, started with her peaceful occupation of French Indo-China with the permission of France, to disrupt the supply routes of China. Economic sanctions from England, Holland and the USA followed. Japan’s repeated attempts at diplomacy and compromise were consistently rebuffed by the USA, culminating in an ultimatum from the USA for Japan’s withdrawal from China, followed by an economic blockade. With the US occupation of Japan, the banking system and corporate structure were demolished under the auspices of an American banker.

Towards the end of the war, however, South Africa was attempting to adopt a banking system similar to that of the Axis states, and some Commonwealth states, namely New Zealand and Australia’s, and a Bill was introduced by Hofmeyr, Minister of Finance, but like the latter countries also, this central bank has failed to embark on a course of state credit creation. It was the South African Labour Party that consistently demanded a state bank that would issue state credit. Indeed, the quotes cited by Goodson of the speeches made by Labour Party members in Parliament on credit creation are, like those of New Zealand Labour stalwart John A. Lee, very instructive.

Goodson then proceeds with an explanation of the New Zealand banking system of the time that was given by the South African advocates of state credit. However, I must add that the South African Labour Party belief that New Zealand’s Finance Minister, Walter Nash, was “one of the strongest advocates of the state banking system,” is an error. Nash was one of John A. Lee’s bitterest opponents in the latter’s efforts to keep the Labour Party to its 1934 election promises, which ultimately resulted in Lee’s expulsion from the party.[19]

After referring to the Australian banking system, South African Labour’s Senator Smith proceeded to describe in similar terms the National Socialist banking system seeing it correctly as analogous, although on a much grander scale, with those of New Zealand. Smith, pointing out that he was not a supporter of Hitler, nonetheless stated that things can be learned from others, including Hitler. This is sufficient today to destroy anyone’s reputation, at a time when scholarship and objectivity are regarded as heretical per se;[20] and we can say that Goodson himself is a present example of this.

Goodson proceeds with his own saga as a director on the SA Reserve Bank Board. In 2002 he attempted to show that the bank was a private entity, not a state institution. In 2003, with 71.1% of the vote of shareholders, Goodson was voted in as a non-executive director. The Board made no secret of its concern at the election of Goodson, who attempted to educate Board members on the nature of fractional reserve banking. The following year a covert campaign by the deputy governor of the Board, Gill Marcus, an ANC stalwart, to unseat the Governor, was noticed by Goodson, and Marcus was unceremoniously told to leave, only to return in 2009 as the state’s appointed new Governor. One of her new measures was to limit the term of non-executives directors, and these were asked to resign prior to the end of their terms. Amidst Goodson’s attempts in 2011 to have corruption and incompetence in the SA Bank Note Company and the SA Mint dealt with, the attitude of Marcus became increasingly antagonistic towards him. In February 2012 the Board moved against Goodson to have him silenced, and he was suspended. In tandem with these measures, Goodson was smeared by the Mail and Guardian the following month.[21] Goodson had made some heretical remarks about Germany in a radio interview with Deanna Spingola in 2011, which were used as a pretext to launch the campaign against him. Goodson provides a substantial list as to why he has adopted a skeptical approach in regard to the “Holocaust,” since the smears against Goodson focus on his “Holocaust” skepticism. Goodson was also damned for having appraised the financial policies of the Hitler regime, and cites luminaries of the day who had done likewise, quoting David Lloyd George, Winston Churchill, H.R.H. the Duke of Windsor, and economist J. K. Galbraith.

Goodson was called into a meeting in May 2012 to resolve his status, and a compensation agreement emerged that ended his position just a few months prior to the end of his term. He was expected no remain mute on the measures that had been taken against him by the Bank, but regards the exposure of financial malfeasance as being in the public inertest and as not being part of any undertaking.

Goodson concludes with an extended discussion on how the banking problems might be solved, citing a comprehensive report that he had submitted to Marcus Gill, who had not understood any of it, and who had forwarded it to an economist for review, who likewise knew nothing of the subject, as related in the ensuing discussion he had with Goodson. Hence the situation is brought up to the present, and Goodson explains the current global debt plight, including a lengthy and unexpected discussion on the adverse manner by which fertility rates are affected. This includes demographic impacts on the white countries, and on Japan and China (in the example of China, I must say: “here’s hoping”). He concludes with examples of community and state banking (North Dakota, Guernsey, Libya), ending with details on how South Africa’s banking system could be reorganized, along with appendices of draft Bills on the mechanics of banking reform.

Notes

1. “The Private Life of Stephen Goodson,” Money Web, August 31, 2003, http://www.moneyweb.co.za/moneyweb-historical-news-news/the-private-life-of-stephen-goodson?sn=Daily%20news%20detail [5]

The story seems balanced and provides an interesting profile.

2. For both Pound and Hamsun see: K. R. Bolton, Artists of the Right (San Francisco: Counter-Currents, 2012). Also: Stephen M. Goodson, “Knut Hamsun: The Soul of Norway,” Inconvenient History, Vol. 5, No. 2, http://inconvenienthistory.com/archive/2013/volume_5/number_2/knut_hamsun.php [6]

3. Brooks Adams, The Law of Civilization and Decay (London: MacMillan, 1896).

4. “Traditional societies,” whether of the Hindu, Muslim, or Christian varieties, etc., place commerce very low down on the pyramid of hierarchy, whereas what a Traditionalist would call a cycle of decay – such as the era of today’s “West” places the merchant at the top of an inverted hierarchy. See: Julius Evola, Revolt Against the Modern World, trans. Guido Stucco (Rochester, Vermont: Inner Traditions International, 1995), and Oswald Spengler on the rise of “money” in the decadent cycle of a civilisation in The Decline of The West (London: George Allen and Unwin, 1971), in particular Vol. II, Chapter XIII.

5. Russell Norman, Member of Parliament, and leader of the New Zealand Green Party, was recently roundly condemned and ridiculed for suggesting the use of “fiat money,” but did not have the knowledge or the fortitude to defend his position and was quickly silenced on the only sensible suggestion that has been offered in New Zealand since the 1930s Labour Government successfully issued state credit for housing.

6. M. J. Savage, iconic leader of the First New Zealand Labour Government.

7. For an alternative Rightist view on the role of money in the collapse of civilizations see: K. R. Bolton, “Oswald Spengler and Brooks Adams: The Economics of Cultural Decline,” in Troy Southgate, ed., Spengler: Thoughts and Perspectives, Vol. Ten (London: Black Front Press, 2012), 179–21.

8. William Cobbett, History of the Protestant Reformation in England and Ireland, 1826.

9. For the influence of Amsterdam Jews and Puritans on the Bank of England see: K R Bolton, The Banking Swindle (London: Black House Publications, 2013), 21–22.

10. On the Left-Right dichotomy and how it has been misunderstood, see: K R Bolton, “Reclaiming the ‘Right’: Origins of the Left Wing – Right Wing Dichotomy,” Ab Aeterno, Academy of Social & Political Research, Wellington, New Zealand, No. 16, July-September 2013.

11. K. R. Bolton, The Banking Swindle, 96–100.

12.K. R. Bolton, Revolution from Above (London: Arktos, 2011), 57–65.

13. K. R. Bolton, The Banking Swindle, op., cit., 145–47.

14. Abolition of Income Tax and Usury Party http://www.aitup.org.za/

15. Perhaps analogous to one recent Labour Government Minister of Finance, Dr Michael Cullen, whose academic specialty was history, and who, on enquiry from a member of the New Zealand Social Credit Institute, stated that credit is created from bank depositors’ savings accounts.

16. Goodson, Inside the Reserve Bank, 71-73.

17. See: K. R. Bolton, “The Geopolitics of White Dispossession,” Richard B. Spencer editor, Radix (Washington Summit Publishers), Vol. 1, 2012, 105–30. Also: K. R. Bolton, Babel Inc. (London: Black House Publishing, 2013), “Decolonization as the Prelude to Globalization.”

18. See: Gottfried Feder, Manifesto for the Breaking of the Financial Slavery of Interest (Surrey: Historical Review Press, 2013 [1919]) translated by Dr. Alexander Jacob. Also: G. Feder, The German State on a National and Socialist Foundation (Historical Review Press, 2013 [1932]), translated by Jacob. Feder would presumably receive more attention today among banking reformers had it not been for his influence on Nazi economics (as might the poet Ezra Pound, author of a series of incisive booklets on banking, had it not been for his support for Fascism).

19. Erik Olssen, John A. Lee (Dunedin, New Zealand: Otago University Press, 1977), passim.

20. K. R. Bolton, “Reductio ad Hitlerum as a Social Evil,” Inconvenient History, Vol. 15, No. 2, http://inconvenienthistory.com/archive/2013/volume_5/number_2/reductio_ad_hitlerum_as_a_social_evil.php [7]

21. Lisa Steyn, “Reserve Bank’s Holocaust Denier,” Mail and Guardian, April 13, 2012, http://mg.co.za/article/2012-04-13-reserve-banks-holocaust-denier [8]

Article printed from Counter-Currents Publishing: http://www.counter-currents.com

URL to article: http://www.counter-currents.com/2014/11/central-banking-and-human-bondage/

URLs in this post:

[1] Image: http://www.counter-currents.com/wp-content/uploads/2014/11/historyofcentralbanking.jpg

[2] A History of Central Banking and the Enslavement of Mankind: http://www.amazon.com/gp/product/0992736536/ref=as_li_tl?ie=UTF8&camp=1789&creative=390957&creativeASIN=0992736536&linkCode=as2&tag=countecurrenp-20&linkId=VJIEPMMQ26CPE523

[3] Inside the South African Reserve Bank: Its Origins and Secrets Exposed: http://www.amazon.com/gp/product/0992736587/ref=as_li_tl?ie=UTF8&camp=1789&creative=390957&creativeASIN=0992736587&linkCode=as2&tag=countecurrenp-20&linkId=E3MZ6PHINX5JZQEG

[4] Image: http://www.counter-currents.com/wp-content/uploads/2014/11/Goodson.jpg

[5] http://www.moneyweb.co.za/moneyweb-historical-news-news/the-private-life-of-stephen-goodson?sn=Daily%20news%20detail: http://www.moneyweb.co.za/moneyweb-historical-news-news/the-private-life-of-stephen-goodson?sn=Daily%20news%20detail

[6] http://inconvenienthistory.com/archive/2013/volume_5/number_2/knut_hamsun.php: http://inconvenienthistory.com/archive/2013/volume_5/number_2/knut_hamsun.php

[7] http://inconvenienthistory.com/archive/2013/volume_5/number_2/reductio_ad_hitlerum_as_a_social_evil.php: http://inconvenienthistory.com/archive/2013/volume_5/number_2/reductio_ad_hitlerum_as_a_social_evil.php

[8] http://mg.co.za/article/2012-04-13-reserve-banks-holocaust-denier: http://mg.co.za/article/2012-04-13-reserve-banks-holocaust-denier

00:05 Publié dans Economie, Livre, Livre | Lien permanent | Commentaires (0) | Tags : livre, banque, finances, économie |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

dimanche, 31 janvier 2010

FMI et Banque Mondiale: quels sont leurs plans?

| FMI et Banque Mondiale : quels sont leurs plans ? |

| « Dans l’actuel contexte du capitalisme financier, il n’existe pas la moindre possibilité de reconstruire un système monétaire international qui soit viable. Cinquante ans après l’accord de Bretton Woods, non seulement le billet vert est une monnaie qui se déprecie, mais les Etats-Unis sont le pays le plus endetté, vivant d’argent et de temps à crédit. Pourquoi aucune politique d’ajustement structurel ne vient-elle les aider à corriger leurs déficits et leurs déséquilivres financiers chroniques ? La réponse se laisse deviner. Cependant, Bretton Woods et les deux sœurs jumelles – pour reprendre une expression de Keynes – que sont le FMI et la Banque mondiale sont bien vivants lorsqu’il s’agit d’intervenir dans les pays du tiers-monde. Les deux institutions ont certes évolué depuis 1944, mais le capitalisme s’est transformé encore plus vite. De sorte que leur existence fait figure d’anachronisme. […]

Le FMI et la Banque mondiale, réduits à un rôle mineur, se sont transformés en gendarmes du capital, notamment dans le tiers-monde, dans l’Europe de l’Est et en Russie. Ajustement structurel, privatisations et libéralisation sont pour tous ces pays sources d’appauvrissement. Des milliards de dollars sont ainsi aspirés chaque année, dans les pays du tiers-monde, par les deux institutions. Un pillage qui se fait sous forme de flux de profis, légalement ou illégalement exportés, de dividendes et de royalties, de fuites de capitaux, de manipulation sur les marchés de capitaux ou de matières premières ; de prix de transfert et de drainage des cerveaux, etc. Le système installé à Bretton Woods n’a malheureusement rien résolu. Le capitalisme est à nouveau dans les tenailles d’une crise économique incontrôlable. Déflation, chômage massif, baisse des prix compétitives : la guerre économique a pris aujourd’hui une dimension et une intensité qui dépassent celles des années 1920 et 1930. »

Frédéric Clairmont, "Bretton Woods : histoire d’une faillite", Manière de Voir n°102, décembre 2008-janvier 2009 |

00:20 Publié dans Economie | Lien permanent | Commentaires (0) | Tags : économie, banque, finances, banque mondiale, ploutocratie, politique internationale |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

dimanche, 23 novembre 2008

Seehofer: la fin du néo-libéralisme

La fin du néo-libéralisme selon le Ministre Président bavarois

Horst Seehofer, 59 ans, est Ministre Président de l’Etat de Bavière au sein de la fédération allemande. Dans un entretien accordé au « Spiegel » (n°46/2008), il évoque la crise avec un langage tonique qui mérite toute notre attention.

Voici quelques-uns de ses propos, recueillis par Conny Neumann et Konstantin von Hammerstein :

« Ce ne sont pas seulement des banques qui se sont effondrées, mais aussi la philosophie du néo-libéralisme pur jus. Je ne m’attendais pas à un effondrement aussi rapide, à une telle vitesse, mais je le voyais venir depuis longtemps. Cette pure maximisation du profit, cette perspective qui ne voit rien d’autre que le rendement ne perçoivent la vie qu’à la lumière de l’économie et négligent tout le reste, qui, pourtant, fait le sel de l’existence. Voilà ce qui s’est effondré ».

Q. : Où cet échec du néo-libéralisme était-il prévu à l'ordre du jour dans notre vie politique ? L’était-il lors de la Diète de la CDU démocrate-chrétienne ? L’était-il dans le fameux « Agenda 2010 » ?

HS : Vous connaissez le débat qui a animé la vie politique allemande quand il s’est agi de protéger le travailleur contre les licenciements. S’agit-il d’une disposition sociale propre à notre société ? La solidarité est-elle encore une valeur « moderne » ou bien l’égoïsme et l’individualisme sont-ils devenus la mesure de toutes choses ? On s’est moqué de moi quand j’ai émis des critiques lorsque Nokia a décidé de quitter l’Allemagne parce que son rendement n’y était que de 20%, ce que la firme estimait trop bas. Le sort des familles de leurs 2000 salariés ne l’intéressait pas. On ne parlait que de cours en bourse et de bilans. Voilà quel était le critère de toute notre politique sociale et cela avait quelques retombées sur le programme de l’Union (des partis démocrates-chrétiens), y compris dans les décisions prises naguère à Leipzig.

(…)

Q. : Pouvez-vous nous expliquer pourquoi les idées néo-libérales ont connu un tel succès au sein des partis de l’Union ?

HS : Parce qu’elles passaient pour « modernes ». C’était, disait-on, le « mainstream ». Tout le monde de l’économie a défendu de telles thèses et si vous émettiez ne fût-ce qu’un petit argument contradictoire, vous passiez pour une vieille baderne. Pour moi, il ne faut ni l’économie planifiée ni le néo-libéralisme. Nous, Allemands, avions inventé le modèle idéal, celui qui était assuré du succès : l’économie sociale de marché.

Q. : Qui peine et s’essouffle.

HS : Pendant plus d’un demi siècle, ce modèle économique a enregistré de grands succès et nous a apporté la stabilité sociale. Bien sûr, comme toute chose, il faut le moderniser et le rénover. En principe, il s’agit de combiner à chaque fois les côtés positifs du marché avec des directives et des filets de sûreté dans le domaine social. Il faut rétablir le bon rapport de force entre la sécurité sociale et l’innovation.

Q. : Le néo-libéralisme est-il mort et bien mort ?

HS : Tant que je suis en vie, oui, pour moi, il est bien mort.

Q. : Et qui va profiter de la mutation des données ?

HS : La population des gens normaux. Jusqu’ici seule une élite, quelques gros, ont profité du néo-libéralisme. Dans la masse de la population, il y a eu perte, diminution du bien-être. Je suis très éloigné mentalement du socialisme mais j’aimerais que l’on retrouve en Allemagne un certain équilibre.

(source : Der Spiegel, n°46/2008 ; adaptation française : Robert Steuckers).

00:40 Publié dans Actualité | Lien permanent | Commentaires (0) | Tags : bavière, allemagne, néo-libéralisme, crise, finances, banque, démocratie chrétienne |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

mercredi, 15 octobre 2008

Neo-Liberale Nachtmerrie

00:20 Publié dans Actualité | Lien permanent | Commentaires (1) | Tags : globalisation, néo-libéralisme, économie, banque, finance, crise |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

vendredi, 10 octobre 2008

Endettement américain, endettement français

Le grand secret : l’endettement des États-Unis comparé à l’endettement français

00:35 Publié dans Economie | Lien permanent | Commentaires (0) | Tags : banque, finances, usure, usurocratie, économie, etats-unis, france |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

vendredi, 03 octobre 2008

L'Amérique et le désordre mondial

| L’Amérique et le désordre mondial Les grands médias parisiens somment les Français de s’intéresser à l’élection présidentielle américaine. Les intellectuels progressistes et les partisans du métissage n’ont d’yeux que pour Barack Obama. Quant aux milieux plus traditionalistes, ils peuvent se consoler avec l’entrée en scène, auprès de John McCain, de la très conservatrice Sarah Palin. Reste que les Français ne participeront pas à l’élection du futur président des Etats-Unis. De toute façon la marge de manœuvre du nouvel élu, quel qu’il soit, sera particulièrement faible : la politique américaine restera largement déterminée par les intérêts de l’hyper classe mondiale et des grands lobbies. Or ce sont eux qui imposent aux Etats Unis une diplomatie et une politique qui contribuent au désordre mondial. Explications : Diplomatie : de l’équilibre des forces à l’unilatéralisme Les périodes de paix ou, en tout cas, de conflits limités correspondent à l’application de règles simples : l’acceptation de l’équilibre des puissances, le respect des frontières des Etats et la non-ingérence des autres dans leurs affaires intérieures. Ces règles sont sans doute imparfaites et moralement discutables mais elles ont assuré de longues périodes de paix : au XIXe siècle, dans la suite du Congrès de Vienne (qui n’avait pas cherché à « punir » la France révolutionnaire) ; dans la deuxième partie du XXe siècle où « l’équilibre de la terreur » entre grandes puissances nucléaires évita toute conflagration générale. L’effondrement de l’Union soviétique puis de la Yougoslavie a conduit l’Occident, sous la direction unilatérale des Etats-Unis, à oublier les règles d’équilibre et de stabilité de l’ordre international : – en multipliant des bases américaines aux frontières mêmes de la Russie ; – en projetant d’intégrer à l’OTAN des pays clairement dans l’orbite de la géopolitique russe, tels que la Géorgie ou l’Ukraine ; – en annulant unilatéralement le traité ABM interdisant les défenses antimissiles et en relançant la course aux armements ; – en construisant un bouclier antimissiles en Pologne visant notamment à permettre éventuellement la destruction de la Russie sans riposte possible de sa part ; – enfin, en reconnaissant unilatéralement l’indépendance du Kosovo et le démembrement de la Serbie, contrairement aux résolutions de l’ONU. Cette politique a conduit au raidissement russe et explique, à défaut de la justifier, la reconnaissance par Moscou de l’indépendance de l’Abkhazie et de l’Ossétie du Sud ; indépendances de confettis d’Etat, au demeurant, ni moins (ni plus) légitimes que celle du Kosovo. Reste que la remise en cause des frontières reconnues en Europe mais aussi dans le reste du monde est une bombe à fragmentation qui peut déboucher sur la balkanisation de la planète ; balkanisation qui peut être recherchée par les tenants de l’affaiblissement des Etats au profit d’un empire mondial. Politique économique : l’irresponsabilité financière américaine Critiquer la Banque centrale européenne (BCE) est le pont aux ânes des hommes politiques français. Or cette institution financière a reçu pour mission dans le Traité de Maastricht (voté par les Français sur recommandations du RPR, de l’UDF et du PS), d’assurer la stabilité de l’euro et de lutter contre l’inflation. En limitant l’émission de monnaie, la BCE remplit son rôle et adopte une gestion de bon père de famille : la politique de la BCE n’a d’ailleurs créé aucun problème au monde. Comme le note l’économiste libéral Florin Aftalion, dans « Les 4 vérités » (http://www.les4verites.com/archives/auteurs-Aftalion-Florin-85.html) : « La FED a, à 2%, un taux de base bien trop bas. Le crédit n'étant pas cher, les Américains empruntent beaucoup trop. (…) La BCE, de son côté, ne modifie pas non plus son taux de base, mais il serait plus sérieux, à 4,25%. » Cette politique irresponsable de la Banque fédérale américaine a créé de la masse monétaire sans contrepartie réelle ; c’est elle qui est à l’origine de la crise immobilière et de l’inflation des matières premières (malgré le calme relatif revenu sur le marché du pétrole). Cette politique a permis à la fois l’enrichissement de l’hyper classe mondiale et l’accès à la propriété de leur logement de nombreux membres insolvables des minorités ethniques. Cette politique se solde aujourd’hui par des pertes dans le monde entier, un appauvrissement des classes moyennes et l’appel aux fonds des contribuables – pas seulement américains et anglais – pour recapitaliser des établissements financiers menacés de faillite. Là aussi c’est l’hybris américaine – financière cette fois – qui est à l’origine de la crise mondiale. Le leurre du changement Reprenant un thème électoral éculé (mais toujours efficace), Barack Obama et John McCain promettent le changement. C’est évidemment un leurre car les forces sociologiques et politiques américaines qui ont intérêt au statu quo restent extrêmement puissantes : – c’est le cas, notamment en politique étrangère, du lobby militaro-industriel, du lobby pétrolier et du lobby israélien qui a placé Joe Biden comme candidat vice-président d’Obama et Joe Lieberman comme candidat secrétaire d’Etat de McCain ; – c’est le cas du lobby « antiraciste » et « antidiscrimination » qui pèsera de tout son poids pour maintenir les avantages de l’Etat providence et du crédit bon marché au profit des minorités ethniques, notamment noires et hispaniques ; – plus généralement, c’est l’ensemble des Américains qui sont dépendants du reste du monde pour leur consommation (qui excède leur production) et leur accès aux matières premières énergétiques dont ils restent les plus demandeurs de la planète. La politique américaine inflationniste de crédit bon marché a donc de beaux jours devant elle ; tout comme la diplomatie impériale des Etats-Unis ou leur politique militaire interventionniste. Polémia 11/09/08 |

00:15 Publié dans Economie | Lien permanent | Commentaires (0) | Tags : etats-unis, finance, géoéconomie, politique, diplomatie, banque, fmi |  |

|  del.icio.us |

del.icio.us |  |

|  Digg |

Digg | ![]() Facebook

Facebook

Les profits du capital financier reposent sur l’endettement, et sur une création illimitée de dettes, au niveau des sociétés, des ménages et du gouvernement, qui grossissent à une vitesse bien plus grande que le produit national brut mondial ou le commerce mondial. Comment espérer, dans ces conditions, atteindre à la stabilité de l’ordre monétaire international ou à l’efficacité du système ? Sa remise en ordre serait-elle compatible avec les intérêts en jeu et avec la libéralisation tous azimuts de l’économie ?

Les profits du capital financier reposent sur l’endettement, et sur une création illimitée de dettes, au niveau des sociétés, des ménages et du gouvernement, qui grossissent à une vitesse bien plus grande que le produit national brut mondial ou le commerce mondial. Comment espérer, dans ces conditions, atteindre à la stabilité de l’ordre monétaire international ou à l’efficacité du système ? Sa remise en ordre serait-elle compatible avec les intérêts en jeu et avec la libéralisation tous azimuts de l’économie ?