Editor’s Note:

What follows is chapter 11, “Modern Centralization,” from Brooks Adams, The Law of Civilization and Decay, second ed. (1895). This chapter is long, but well worth reading.

Here Adams explains, with a wealth of historical detail, the economic evil wrought by gold and silver currency, particularly a single gold standard. Currency is the life blood of economic progress. Gold and silver, however, are scarce and subject to hoarding. Thus they lead to the economic equivalent of anemia.

Adams argues that the technological groundwork of the Industrial Revolution existed long before the middle of the 18th century. What stood in the way of putting that technology to work was lack of capital, for money consisted of gold and silver, which are scarce commodities subject to hoarding.

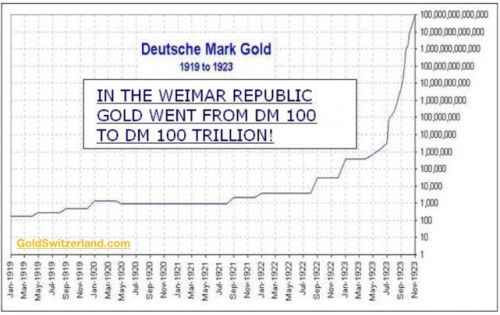

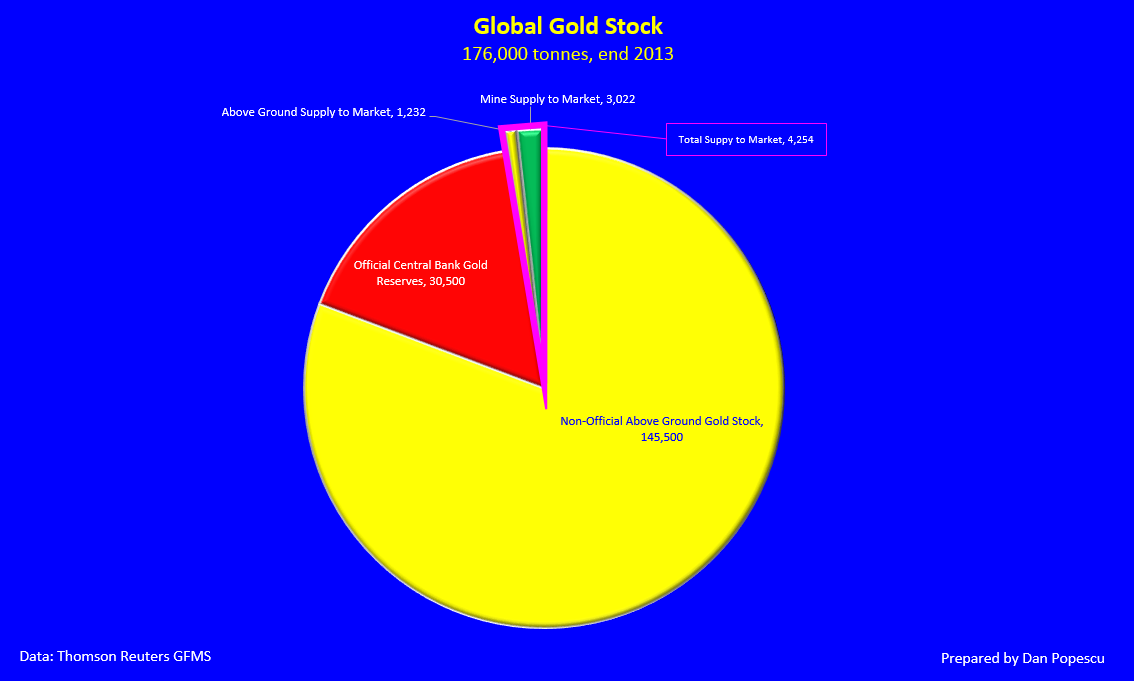

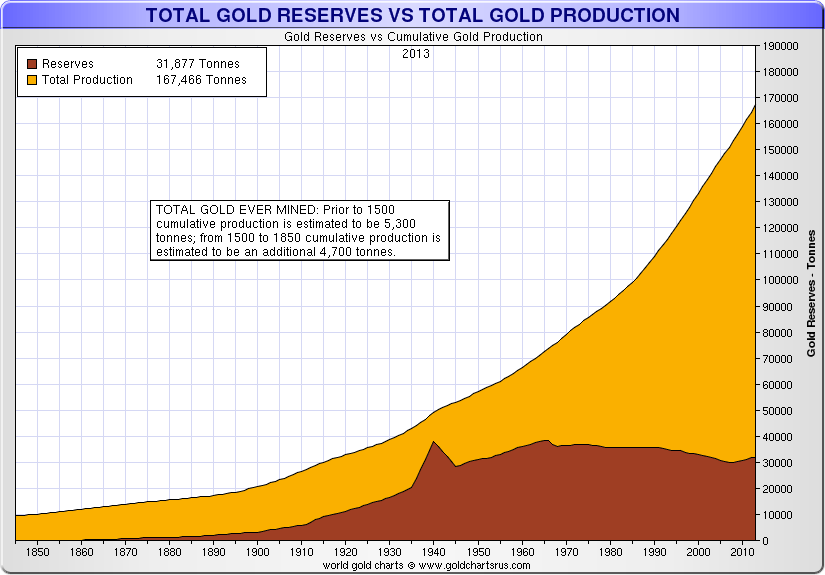

The gold supply also fluctuates wildly based on highly arbitrary factors, such as gold strikes, speculative bubbles and panics, and the plunder of vast gold rich peoples like the Aztecs, Inca, and the various principalities of India.

Adams argues that one of the necessary conditions for the Industrial Revolution in England was the immense influx of gold and silver seized in India beginning in the 1750s. This loosened the money supply enough to allow industrial pioneers like James Watt and Matthew Boulton to capitalize their visions and revolutionize production. (Of course, a Social Credit economy armed with fiat currency, could have expedited the Industrial Revolution without the necessity of wholesale plunder to seize gold and silver.)

Gold and silver money are also deflationary. This means that as economic production grows, money becomes scarcer and more costly. This means that borrowers are ruined, for to pay back debts denominated in increasingly scarce gold or silver, they must work harder and harder with each passing year until their debts consume the whole of their production.

When gold is plentiful due to a random event like the California gold rush, the economy is stimulated. But if the economy is particularly productive, the supply of precious metals can never keep pace with economic growth, which thus leads to a deflationary contraction, causing people to lose farms and businesses to their creditors. Thus gold and silver currency are a cause of economic booms and busts. With gold and silver currency, producers are ruined by their very productivity. But nothing is more destructive than a pure gold standard, because gold is scarcer than silver and thus even more subject to hoarding.

In discussing the phenomena of the highly centralized society in which he lived, Mill defined capital “as the accumulated stock of human labor.” In other words, capital may be considered as stored energy; but most of this energy flows in fixed channels, money alone is capable of being transmuted immediately into any form of activity. Therefore the influx of the Indian treasure, by adding considerably to the nation’s cash capital, not only increased its stock of energy, but added much to its flexibility and the rapidity of its movement.

In discussing the phenomena of the highly centralized society in which he lived, Mill defined capital “as the accumulated stock of human labor.” In other words, capital may be considered as stored energy; but most of this energy flows in fixed channels, money alone is capable of being transmuted immediately into any form of activity. Therefore the influx of the Indian treasure, by adding considerably to the nation’s cash capital, not only increased its stock of energy, but added much to its flexibility and the rapidity of its movement.

Very soon after Plassey the Bengal plunder began to arrive in London, and the effect appears to have been instantaneous, for all authorities agree that the “industrial revolution,” the event which has divided the nineteenth century from all antecedent time, began with the year 1760. Prior to 1760, according to Baines, the machinery used for spinning cotton in Lancashire was almost as simple as in India;[1] while about 1750 the English iron industry was in full decline because of the destruction of the forests for fuel. At that time four-fifths of the iron in use in the kingdom came from Sweden.

Plassey was fought in 1757, and probably nothing has ever equaled the rapidity of the change which followed. In 1760 the flying-shuttle appeared, and coal began to replace wood in smelting. In 1764 Hargreaves invented the spinning-jenny, in 1779 Crompton contrived the mule, in 1785 Cartwright patented the power-loom, and, chief of all, in 1768 Watt matured the steam-engine, the most perfect of all vents of centralizing energy. But though these machines served as outlets for the accelerating movement of the time, they did not cause that acceleration. In themselves inventions are passive, many of the most important having lain dormant for centuries, waiting for a sufficient store of force to have accumulated to set them working. That store must always take the shape of money, and money not hoarded, but in motion.

Thus printing had been known for ages in China before it came to Europe; the Romans probably were acquainted with gunpowder; revolvers and breech-loading cannon existed in the fifteenth and sixteenth centuries, and steam had been experimented upon long before the birth of Watt. The least part of Watt’s labor lay in conceiving his idea; he consumed his life in marketing it. Before the influx of the Indian treasure, and the expansion of credit which followed, no force sufficient for this purpose existed; and had Watt lived fifty years earlier, he and his invention must have perished together. Considering the difficulties under which Matthew Boulton, the ablest and most energetic manufacturer of his time, nearly succumbed, no one can doubt that without Boulton’s works at Birmingham the engine could not have been produced, and yet before 1760 such works could not have been organized. The factory system was the child of the “industrial revolution,” and until capital had accumulated in masses capable of giving solidity to large bodies of labor, manufactures were necessarily carried on by scattered individuals, who combined a handicraft with agriculture. Defoe’s charming description of Halifax about the time Boulton learned his trade, is well known:

The nearer we came to Halifax, we found the houses thicker, and the villages greater, in every bottom; . . . for the land being divided into small enclosures, from two acres to six or seven each, seldom more, every three or four pieces of land had an house belonging to them.

In short, after we had mounted the third hill, we found the country one continued village, tho’ every way mountainous, hardly an house standing out of a speaking distance from another; and, as the day cleared up, we could see at every house a tenter, and on almost every tenter a piece of cloth, kersie, or shalloon; which are the three articles of this countries labor. . . .

This place then seems to have been designed by providence for the very purposes to which it is now allotted. . . . Nor is the industry of the people wanting to second these advantages. Tho’ we met few people without doors, yet within we saw the houses full of lusty fellows, some at the dye vat, some at the loom, others dressing the cloths; the women and children carding, or spinning; all employed from the youngest to the oldest; scarce anything above four years old, but its hands were sufficient for its own support. Not a beggar to be seen, nor an idle person, except here and there in an alms-house, built for those that are antient, and past working. The people in general live long; they enjoy a good air; and under such circumstances hard labor is naturally attended with the blessing of health, if not riches.[2]

To the capitalist, then, rather than to the inventor, civilization owes the steam engine as a part of daily life, and Matthew Boulton was one of the most remarkable of the race of producers whose reign lasted down to Waterloo. As far back as tradition runs the Boultons appear to have been Northamptonshire farmers, but Matthew’s grandfather met with misfortunes under William, and sent his son to Birmingham to seek his fortune in trade. There the adventurer established himself as a silver stamper, and there, in 1728, Matthew was born. Young Boulton early showed both energy and ingenuity, and on coming of age became his father’s partner, thenceforward managing the business. In 1759, two years after the conquest of Bengal, the father died, and Matthew, having married in 1760, might have retired on his wife’s property, but he chose rather to plunge more deeply into trade. Extending his works, he built the famous shops at Soho, which he finished in 1762 at an outlay of £20,000, a debt which probably clung to him to the end of his life.

Boulton formed his partnership with Watt in 1774, and then began to manufacture the steam-engine, but he met with formidable difficulties. Before the sales yielded any return, the outlay reduced him to the brink of insolvency; nor did he achieve success until he had exhausted his own and his friends’ resources.

He mortgaged his lands to the last farthing; borrowed from his personal friends; raised money by annuities; obtained advances from bankers; and had invested upwards of forty thousand pounds in the enterprise before it began to pay.[3]

Agriculture, as well as industry, felt the impulsion of the new force. Arthur Young remarked in 1770, that within ten years there had been “more experiments, more discoveries, and more general good sense displayed in the walk of agriculture than in an hundred preceding ones”; and the reason why such a movement should have occurred seems obvious. After 1760 a complex system of credit sprang up, based on a metallic treasure, and those who could borrow had the means at their disposal of importing breeds of cattle, and of improving tillage, as well as of organizing factories like Soho. The effect was to cause rapid centralization. The spread of high farming certainly raised the value of land, but it also made the position of the yeomanry untenable, and nothing better reveals the magnitude of the social revolution wrought by Plassey, than the manner in which the wastes were enclosed after the middle of the century.

Between 1710 and 1760 only 335,000 acres of the commons were absorbed; between 1760 and 1843, nearly 7,000,000. In eighty years the yeomanry became extinct. Many of these small farmers migrated to the towns, where the stronger, like the ancestor of Sir Robert Peel, accumulated wealth in industry, the weaker sinking into factory hands. Those who lingered on the land, toiled as day laborers. Possibly since the world began, no investment has ever yielded the profit reaped from the Indian plunder, because for nearly fifty years Great Britain stood without a competitor. That she should have so long enjoyed a monopoly seems at first mysterious, but perhaps the condition of the Continent may suggest an explanation. Since Italy had been ruined by the loss of the Eastern trade, she had ceased to breed the economic mind; consequently no class of her population could suddenly and violently accelerate their movements. In Spain the priest and soldier had so thoroughly exterminated the skeptic, that far from centralizing during the seventeenth century, as England and France had done, her empire was in full decline at the revolution of 1688. In France something similar had happened, though in a much less degree. After a struggle of a century and a half, the Church so far prevailed in 1685 as to secure the revocation of the Edict of Nantes. At the revocation many Huguenots went into exile, and thus no small proportion of the economic class, who should have pressed England hardest, were driven across the Channel, to add their energy to the energy of the natives. Germany lacked capital. Hemmed in by enemies, and without a seacoast, she had been at a disadvantage in predatory warfare; accordingly she did not accumulate money, and failed to consolidate until, in 1870, she extorted a treasure from France. Thus, in 1760, Holland alone remained as a competitor, rich, maritime, and peopled by Protestants. But Holland lacked the mass possessed by her great antagonist, besides being without minerals; and accordingly, far from accelerating her progress, she proved unable to maintain her relative rate of advance.

Thus isolated, and favored by mines of coal and iron, England not only commanded the European and American markets, at a time when production was strained to the utmost by war, but even undersold Hindu labor at Calcutta. In some imperfect way her gains may be estimated by the growth of her debt, which must represent savings. In 1756, when Clive went to India, the nation owed £74,575,000, on which it paid an interest of £2,753,000. In 1815 this debt had swelled to £861,000,000, with an annual interest charge of £32,645,000. In 1761 the Duke of Bridgewater finished the first of the canals which were afterward to form an inland water-way costing £50,000,000, or more than two-thirds of the amount of the public debt at the outbreak of the Seven Years’ War. Meanwhile, also, steam had been introduced, factories built, turnpikes improved, and bridges erected, and all this had been done through a system of credit extending throughout the land. Credit is the chosen vehicle of energy in centralized societies, and no sooner had treasure enough accumulated in London to offer it a foundation, than it shot up with marvelous rapidity.

From 1694 to Plassey, the growth had been relatively slow. For more than sixty years after the foundation of the Bank of England, its smallest note had been for £20, a note too large to circulate freely, and which rarely traveled far from Lombard Street. Writing in 1790, Burke mentioned that when he came to England in 1750 there were not “twelve bankers’ shops” in the provinces, though then, he said, they were in every market town.[4] Thus the arrival of the Bengal silver not only increased the mass of money, but stimulated its movement; for at once, in 1759, the bank issued £10 and £15 notes, and, in the country, private firms poured forth a flood of paper. At the outbreak of the Napoleonic wars, there were not far from four hundred provincial houses, many of more than doubtful solvency. Macleod, who usually does not exaggerate such matters, has said, that grocers, tailors, and drapers inundated the country with their miserable rags.[5]

The cause of this inferiority of the country bankers was the avarice of the Bank of England, which prevented the formation of joint stock companies, who might act as competitors; and, as the period was one of great industrial and commercial expansion, when the adventurous and producing classes controlled society, enough currency of some kind was kept in circulation to prevent the prices of commodities from depreciating relatively to coin. The purchasing power of a currency is, other things being equal, in proportion to its quantity. Or, to put the proposition in the words of Locke, “the value of money, in general, is the quantity of all the money in the world in proportion to all the trade.”[6] At the close of the eighteenth century, many causes combined to make money plentiful, and therefore to cheapen it. Not only was the stock of bullion in England increased by importations from India, but, for nearly a generation, exports of silver to Asia fell off. From an average of £600,000 annually between 1740 and 1760, the shipments of specie by the East India Company fell to £97,500 between 1760 and 1780; nor did they rise to their old level until after the close of the administration of Hastings, when trade returned to normal channels. After 1800 the stream gathered volume, and between 1810 and 1820 the yearly consignment amounted to £2, 827,000, or to nearly one-half of the precious metals yielded by the mines.

From the crusades to Waterloo, the producers dominated Europe, the money-lenders often faring hardly, as is proved by the treatment of the Jews. From the highest to the lowest, all had wares to sell; the farmer his crop, the weaver his cloth, the grocer his goods, and all were interested in maintaining the value of their merchandise relatively to coin, for they lost when selling on a falling market. By degrees, as competition sharpened after the Reformation, a type was developed which, perhaps, may be called the merchant adventurer; men like Child and Boulton, bold, energetic, audacious. Gradually energy vented itself more and more freely through these merchants, until they became the ruling power in England, their government lasting from 1688 to 1815. At length they fell through the very brilliancy of their genius. The wealth they amassed so rapidly, accumulated, until it prevailed over all other forms of force, and by so doing raised another variety of man to power. These last were the modern bankers.

With the advent of the bankers, a profound change came over civilization, for contraction began. Self-interest had from the outset taught the producer that, to prosper, he should deal in wares which tended rather to rise than fall in value, relatively to coin. The opposite instinct possessed the usurer; he found that he grew rich when money appreciated, or when the borrower had to part with more property to pay his debt when it fell due, than the cash lent him would have bought on the day the obligation was contracted. As, toward the close of the eighteenth century, the great hoards of London passed into the possession of men of the latter type, the third and most redoubtable variety of the economic intellect arose to prominence, a variety of which perhaps the most conspicuous example is the family of Rothschild.

In one of the mean and dirty houses of the Jewish quarter of Frankfort, Mayer Amschel was born in the year 1743. The house was numbered 152 in the Judengasse, but was better known as the house of the Red Shield, and gave its name to the Amschel family. Mayer was educated by his parents for a rabbi; but, judging himself better fitted for finance, he entered the service of a Hanoverian banker named Oppenheim, and remained with him until he had saved enough to set up for himself. Then for some years he dealt in old coins, curiosities and bullion, married in 1770, returned to Frankfort, established himself in the house of the Red Shield, and rapidly advanced toward opulence. Soon after he gave up his trade in curiosities, confining himself to banking, and his great step in life was made when he became “Court Jew” to the Landgrave of Hesse. By 1804 he was already so prosperous that he contracted with the Danish Government for a loan of four millions of thalers.

Mayer had five sons, to whom he left his business and his wealth. In 18 12 he died, and, as he lay upon his death-bed, his last words were, “You will soon be rich among the richest, and the world will belong to you.”[7] His prophecy came true. These five sons conceived and executed an original and daring scheme. While the eldest remained at Frankfort, and conducted the parent house, the four others migrated to four different capitals, Naples, Vienna, Paris, and London, and, acting continually in consort, they succeeded in obtaining a control over the money market of Europe, as unprecedented as it was lucrative to themselves.

Of the five brothers, the third, Nathan, had commanding ability. In 1798 he settled in London, married in 1806 the daughter of one of the wealthiest of the English Jews, and by 1815 had become the despot of the Stock Exchange; “peers and princes of the blood sat at his table, clergymen and laymen bowed before him.” He had no tastes, either literary, social, or artistic; “in his manners and address he seemed to delight in displaying his thorough disregard of all the courtesies and amenities of civilized life”; and when asked about the future of his children he said, “I wish them to give mind, soul, and heart, and body—everything to business. That is the way to be happy.”[8] Extremely ostentatious, though without delicacy or appreciation, “his mansions were crowded with works of art, and the most gorgeous appointments.” His benevolence was capricious; to quote his own words, “Sometimes to amuse myself I give a beggar a guinea. He thinks it is a mistake, and for fear I shall find it out off he runs as hard as he can. I advise you to give a beggar a guinea sometimes. It is very amusing.”[9]

Though an astonishingly bold and unscrupulous speculator, Nathan probably won his chief successes by skill in lending, and, in this branch of financiering, he was favored by the times in which he lived. During the long wars Europe plunged into debt, contracting loans in depreciated paper, or in coin which was unprecedentedly cheap because of the abundance of the precious metals.

In the year 1809, prices reached the greatest altitude they ever attained in modern, or even, perhaps, in all history. There is something marvelously impressive in this moment of time, as the world stood poised upon the brink of a new era. To the contemporary eye Napoleon had reached his zenith. Everywhere victorious, he had defeated the English in Spain, and forced the army of Moore to embark at Corunna; while at Wagram he had brought Austria to the dust. He seemed about to rival Caesar, and establish a military empire which should consolidate the nations of the mainland of Europe. Yet in reality one of those vast and subtle changes was impending, which, by modifying the conditions under which men compete, alter the complexion of civilizations, and which has led in the course of the nineteenth century to the decisive rejection of the martial and imaginative mind.

In April 1810 Bolivar obtained control at Caracas, and, with the outbreak of the South American revolutions, the gigantic but imaginative empire of Spain passed into the acute stage of disintegration. On December 19 of the same year, the Emperor Alexander opened the ports of Russia to neutral trade. By so doing Alexander repudiated the “continental system” of Napoleon, made a breach with him inevitable, and thus brought on the campaign of Moscow, the destruction of the Grand Army, and the close of French military triumphs on the hill of Waterloo. From the year 1810, nature has favored the usurious mind, even as she favored it in Rome, from the death of Augustus.

Moreover, both in ancient and modern life, the first symptom of this profound economic and intellectual revolution was identical. Tacitus has described the panic which was the immediate forerunner of the rise of the precious metals in the first century; and in 1810 a similar panic occurred in London, when prices suddenly fell fifteen per cent,[10] and when the most famous magnate of the Stock Exchange was ruined and killed. The great houses of Baring and of Goldsmid had undertaken the negotiation of a government loan of £14,000,000. To the surprise of these eminent financiers values slowly receded, and, in September, the death of Sir Francis Baring precipitated a crisis; Abraham Goldsmid, reduced to insolvency, in despair committed suicide; the acutest intellects rose instantaneously upon the corpses of the weaker, and the Rothschilds remained the dictators of the markets of the world. From that day to this the slow contraction has continued, with only the break of little more than twenty years, when the gold of California and Australia came in an overwhelming flood; and, from that day to this, the same series of phenomena have succeeded one another, which eighteen hundred years ago marked the emasculation of Rome.

At the peace, many causes converged to make specie rise; the exports of bullion to the East nearly doubled; America grew vigorously, and mining was interrupted by the revolt of the Spanish colonies. Yet favorable as the position of the creditor class might be, it could be improved by legislation, and probably no financial policy has ever been so ably conceived, or so adroitly executed, as that masterpiece of state-craft which gave Lombard Street control of the currency of Great Britain.

Under the reign of the producers, values had generally been equalized by cheapening the currency when prices fell. In the fourteenth, fifteenth, and sixteenth centuries, the penny had been systematically degraded, to keep pace with the growing dearth of silver. When the flood of the Peruvian bullion had reached its height in 1561, the currency regained its fineness; but in 1601 the penny lost another half-grain of weight, and, though not again adulterated at the mint, the whole coinage suffered so severely from hard usage that, under the Stuarts, it fell to about two-thirds of its nominal value. A re-coinage took place under William, but then paper came in to give relief, and the money in circulation continued to degenerate, as there was no provision for the withdrawal of light pieces. By 1774, the loss upon even the guinea had become so great that Parliament intervened, and Lord North recommended “that all the deficient gold coin should be called in, and re-coined” and also that the “currency of the gold coin should, in future, be regulated by weight as well as by tale . . . and that the several pieces should not be legal tender, if they were diminished, by wearing or otherwise, below a certain weight, to be determined by proclamation.”[11]

By such means as this, the integrity of the metallic money was at length secured; but the emission of paper remained unlimited, and in 1797 even the Bank of England suspended cash payments. Then prices advanced as they had never advanced before, and, during the first ten years of the nineteenth century, ‘the commercial adventurers reached their meridian. From 1810 they declined in power; but for several preceding generations they had formed a true aristocracy, shaping the laws and customs of their country. They needed an abundant currency, and they obtained it through the Bank. On their side the directors recognized this duty to be their chief function, and laid it down as a principle that all legitimate commercial paper should always be discounted. If interest rose, the rise proved a dearth of money, and they relieved that dearth with notes. Lord Overstone has thus explained the system of banking which was accepted, without question, until 1810: “A supposed obligation to meet the real wants of commerce, and to discount all commercial bills arising out of legitimate transactions, appears to have been considered as the principle upon which the amount of the circulation was to be regulated.”[12]

And yet, strangely enough, even the adversaries of this system admitted that it worked well. A man as fixed in his opinions as Tooke, could not contain his astonishment that “under the guidance of maxims and principles so unsound and of such apparently mischievous tendency, as those professed by the governors and some of the directors of the Bank in 1810, such moderation and . . . such regularity of issue should, under chances and changes in politics and trade, unprecedented in violence and extent, have been preserved, as that a spontaneous readjustment between the value of the gold and the paper should have taken place, as it did, without any reduction of their circulation.”[13]

With such a system the currency tended to fall rather than to rise in value, in comparison with commodities, and for this reason the owners of the great hoards were at a disadvantage. What powerful usurers, like Rothschild, wanted, was a legal tender fixed in quantity, which, being unable to expand to meet an increased demand, would rise in price. Moreover, they needed a circulating medium sufficiently compact to be controlled by a comparatively small number of capitalists, who would thus, under favorable conditions, hold the whole debtor community at their mercy.

If the year 1810 be taken as the point at which the energy stored in accumulations of money began to predominate in England, the revolution which ended in the overthrow of the producers, advanced, with hardly a check, to its completion by the “Bank Act” of 1844. The first symptom of approaching change was the famous “Bullion Committee,” appointed on the motion of Francis Horner in 1810. This report is most interesting, for it marks an epoch, and in it the struggle for supremacy between the lender and the borrower is brought out in full relief.

To the producer, the commodity was the measure of value; to the banker, coin. The producer sought a currency which should retain a certain ratio to all commodities, of which gold was but one. The banker insisted on making a fixed weight of the metal he controlled, the standard from which there was no appeal.

A distinguished merchant, named Chambers, in his evidence before the Committee, put the issue in a nutshell:

Q. At the Mint price of standard gold in this country, how much gold does a Bank of England note for one pound represent?

A. 5 dwts. 3 grs.

Q. At the present market price of standard gold of £4 12. per ounce, how much gold do you get for a Bank of England note for one pound?

A. 4 dwts. 8 grs.

Q. Do you consider that a Bank of England note for one pound, under these present circumstances, is exchangeable in gold for what it represents of that metal?

A. I do not conceive gold to be a fairer standard for Bank of England notes than indigo or broadcloth.

Although the bankers controlled the “Bullion Committee,” the mercantile interest still maintained itself in Parliament, and the resolutions proposed by the chairman in his report were rejected in the Commons by a majority of about two to one. The tide, however, had turned, and perhaps the best index of the moment at which the balance of power shifted, may be the course of Peel. Of all the public men of his generation. Peel had the surest instinct for the strongest force. Rarely, if ever, did this instinct fail him, and after 1812 his intuition led him to separate from his father; as, later in life, it led him to desert his party in the crisis of 1845. The first Sir Robert Peel, the great manufacturer, who made the fortune of the family, had the producer’s instinct and utterly opposed contraction. In 1811 he voted against the report of the Bullion Committee, and then his son voted with him. After 1816, however, the younger Peel became the spokesman of Lombard Street, and the story is told that when the bill providing for cash payments passed in July, 1819, the old man, after listening to his son’s great speech, said with bitterness: “Robert has doubled his fortune, but ruined his country.”[14]

Probably Waterloo marked the opening of the new era, for after Waterloo the bankers met with no serious defeat. At first they hardly encountered opposition. They began by discarding silver. In 1817 the government made 123 and 274/1000 grs. of gold the unit of value, the coin representing this weight of metal ceasing to be a legal tender when deficient by about half a grain. The standard having thus been determined, it remained to enforce it. By this time Peel had been chosen by the creditor class as their mouthpiece, and in 1819 he introduced a bill to provide for cash payments. He found little resistance to his measure, and proposed 1823 as the time for the return; as it happened, the date was anticipated, and notes were redeemed in gold from May 1, 1821. As far as the coinage was concerned, this legislation completed the work, but the task of limiting discounts remained untouched, a task of even more importance, for, as long as the Bank continued discounting bills, and thus emitting an unlimited quantity of notes whenever the rate of interest rose, debtors not only might always be able to face their obligations, but the worth of money could not be materially enhanced. This question was decided by the issue of the panic of 1825, brought on by the Resumption Act.

At the suspension of 1797, paper in small denominations had been authorized to replace the coin which disappeared, but this act expired two years after the return to specie payments. Therefore, as time elapsed, the small issues began to be called in, and, according to Macleod, the country circulation, by 1823, had contracted about twelve per cent. The Bank of England also withdrew a large body of notes in denominations less than five pounds, and, to fill the gap, hoarded some twelve million sovereigns, a mass of gold about equal to the yield of the mines for the preceding seven or eight years. This gold had to be taken from the currency of Europe, and the sudden contraction caused a shock which vibrated throughout the West.

In France gold coinage almost ceased, and prices dropped heavily, declining twenty-four per cent between 1819 and 1822. Yet perhaps the most vivid picture of the distress caused by this absorption of gold, is given in a passage written by Macleod, to prove that Peel’s act had nothing to do with the catastrophe:

There was one perfectly satisfactory argument to show that the low prices of that year had nothing to do with the Act of 1819, namely, that prices of all sorts of agricultural produce were equally depressed all over the continent of Europe from the same cause. The fluctuations, indeed, on the continent were much more violent than even in England. . . . The same phenomena were observed in Italy. A similar fall, but not to so great an extent, took place at Lisbon. What could the Act of 1819 have to do with these places?[15]

The severe and protracted depression, while affecting all producers, bore with peculiar severity upon the gentry, whose estates were burdened with mortgages and all kinds of settlements, so much so that frequently properties sank below their encumbrances, and the owners were beggared. At the opening of Parliament, both Houses were overwhelmed with petitions for aid. Among these petitions, one of the best known was presented to the Commons in May, 1822, by Charles Andrew Thompson, of Chiswick, which serves to show the keenness of the distress among debtors owning land.

Thompson stated, in substance, that in 1811 he and his father, being wealthy merchants, purchased an estate in Hertfordshire for £62,000, and afterward laid out £10,000 more in improvements. That in 1812 they entered into a contract for another estate, whose price was £60,000, but, a question having arisen as to the title, a lawsuit intervened, and, before judgment, the petitioner and his father had experienced such losses that they could not pay the sum adjudged due by the court. Thereupon, to raise money, they mortgaged both estates for £65,000. In July, 1821, both estates were offered for sale, but they failed to bring the amount for which they were mortgaged. Estates in other counties which cost £33,166, had been sold for £12,000, and through the depression of trade the petitioners had become bankrupt. In 1822 the petitioner’s father died of a broken heart; and he himself remained a ruined man, with seven children of his own, ten of his brother’s, and seven of his sister’s all depending on him.[16]

The nation seemed upon the brink of some convulsion, for the gentry hardly cared to disguise their design of effecting a readjustment of both public and private debts. Passions ran high, and in June, 1822, a long debate followed upon a motion, made by Mr. Western, to inquire into the effects produced by the resumption of cash payments. The motion was indeed defeated, but defeated by a concession which entailed a catastrophe up to that time unequalled in the experience of Great Britain. To save the “Resumption Act” the ministry in July brought in a bill to respite the small notes until 1833, a measure which at once quieted the agitation, but which produced the most far-reaching and unexpected results.

According to Francis, the country banks augmented their issues fifty per cent between 1822 and 1825,[17] nor was this increase of paper the only or the most serious form taken by the inflation. The great hoard of sovereigns, accumulated by the Bank to replace its small notes, was made superfluous; and, in a memorandum delivered by the directors to the House of Commons, no less than £14,200,000 were stated to have been thrown on their hands in 1824 by this change of policy.[18] The effect was to create a veritable glut of gold in the United Kingdom; prices rose abnormally—fifteen per cent—between 1824 and 1825.

As values tended upward, a frenzy of speculation seized upon a people who had long suffered from the grinding of contraction, and meanwhile the Bank, adhering to its old policy, freely discounted all the sound bills brought them. In 1824 prices rose above the Continental level, and gold, being cheaper in London than in Paris, began to flow thither. The Bank reserve steadily fell. In March, 1825, the fever reached its height, and a decline set in, while the directors, anxious at the condition of their reserve in May, attempted to restrict their issues. The consequence was sharp contraction, and in November the crash came. Mr. Huskisson stated, in the House of Commons, that for forty-eight hours it was impossible to convert even government securities into cash. Exchequer bills, bank stock, and East India stock were alike unsalable, and many of the richest merchants of London walked the streets, not knowing whether on the morrow they might not be insolvent. “It is said” the Bank itself “must have stopped payment, and that we should have been reduced to a state of barter, but for a boxful of old one and two-pound notes which was discovered by accident.”[19] What happened in the Bank parlor during those days is unknown. Probably the pressure of the mercantile classes became too sharp to be withstood, perhaps even the strongest bankers were alarmed; but, at all events, the financial policy changed completely. Contraction was abandoned, the Bank reverted to the system of 18 10, and in an instant relief came. “We lent by every possible means, and in modes we had never adopted before; . . . we not only discounted outright, but we made advances on deposit of bills of exchange to an immense amount.” The Bank emitted five millions in notes in four days, and “this audacious policy was crowned with the most complete success, the panic was stayed almost immediately.”[20]

With an expansion of the currency sufficient to furnish the means of paying debts, the panic passed away, but the disaster gave the bankers their opportunity; they seized it, and thenceforward their hold upon the community never, even for an instant, relaxed. The administration fell into discredit, and turned for assistance to the only men who promised to give them effective support: these were the capitalists of Lombard Street, whose first care was to obtain a statute prohibiting the small notes, which, they alleged, were the cause of the misfortune of 1825. The act they demanded passed in 1826, and about this time Samuel Loyd rose into prominence, who was, perhaps, the greatest financier of modern times. Cautious and sagacious, though resolute and bold, gifted with an amazing penetration into the complex causes which control the competition of modern life, he swayed successive administrations, and crushed down the fiercest opposition. Apparently he never faltered in his course, and down to the day of his death he sneered at the panic-stricken directors, who only saved themselves from bankruptcy by accidentally remembering and issuing a “parcel of old discarded one-pound notes . . . drawn forth from a refuse cellar in 1825.”[21]

Loyd’s father began life somewhat humbly as a dissenting minister in Wales, but, after his marriage, he entered a Manchester firm, and subsequently founded in London the house of Jones, Loyd and Co., afterward merged in the London and Westminster Bank, one of the largest concerns in the world. Samuel did not actually succeed his father until 1844, but much earlier he had grown to be the recognized chief of the moneyed interest, and Sir Robert Peel long served as his lieutenant. Loyd was the man who conceived the Bank Act of 1844, who succeeded in laying his grasp upon the currency of the kingdom, and in whose words, therefore, the policy of the new governing class is best stated:

A paper-circulation is the substitution of paper . . . in the place of the precious metals. The amount of it ought therefore to be equal to what would have been the amount of a metallic circulation; and of this the best measure is the influx or efflux of bullion.[22]

By the provisions of that Act [the Bank Act of 1844] it is permitted to issue notes to the amount of £14,000,000 as before—that is, with no security for the redemption of the notes on demand beyond the legal obligation so to redeem them. But all fluctuations in the amount of notes issued beyond this £14,000,000 must have direct reference to corresponding fluctuations in the amount of gold.[23]

Thus Loyd’s principle, which he embodied in his statute, was the rigid limitation of the currency to the weight of gold available for money. “When . . . notes are permitted to be issued, the number in circulation should always be exactly equal to the coin which would be in circulation if they did not exist.”[24] In 1845 the Bank Act was extended to Scotland, except that there small notes were still tolerated; the expansion of provincial paper was prohibited, and England reverted to the economic condition of Byzantium—a condition of contraction in which the debtor class lies prostrate, for, the legal tender being absolutely limited, when creditors choose to withdraw their loans, payment becomes impossible.

Perhaps no financier has ever lived abler than Samuel Loyd. Certainly he understood as few men, even of later generations, have understood the mighty engine of the single standard. He comprehended that, with expanding trade, an inelastic currency must rise in value; he saw that, with sufficient resources at command, his class might be able to establish such a rise, almost at pleasure; certainly that they could manipulate it when it came, by taking advantage of foreign exchanges. He perceived moreover that, once established, a contraction of the currency might be forced to an extreme, and that when money rose beyond price, as in 1825, debtors would have to surrender their property on such terms as creditors might dictate.

Furthermore, he reasoned that under pressure prices must fall to a point lower than in other nations, that then money would flow from abroad, and relief would ultimately be given, even if the government did not interfere; that this influx of gold would increase the quantity of money, by so doing would again raise prices, and that, when prices rose, pledges forfeited in the panic might be resold at an advance. He explained the principle of this rise and fall of values, with his usual lucidity, to a committee of the House of Lords, which investigated the panic of 1847:

Monetary distress tends to produce fall of prices; that fall of prices encourages exports and diminishes imports; consequently it tends to promote an influx of bullion. I can quote a fact of rather a striking character, which tends to show that a contracting operation upon the circulation tends to cheapen the cost of our manufactured productions, and therefore to increase our exports.[25]

He then stated that during the panic he had received a letter “from a person of great importance in Lancashire,” begging him to use his influence with the ministry “to be firm in maintaining the act,—to be firm in resisting these applications for relaxation,” because in Lancashire the manufacturers were struggling to “resist the improperly high price of the raw material of cotton.” “That letter reached me the very morning that the letter of the government was issued [suspending the act], and almost immediately the raw cotton rose in price.”

Q. The writer of that letter was probably a man of considerable substance, a very wealthy man, with abundant capital to carry on his business?

A. He had recently retired from business. I can state another circumstance that occurred in London corroborative of the same results. Within half an hour of the time that the notes summoning the Court of Directors . . . were issued, parties, inferring probably . . . that a relaxation was about to take place, sent orders to withdraw goods from a sale which was then going on.[26]

The history of half a century has justified the diagnosis of this eminent financier. As followed out by his successors, Loyd’s policy has not only forced down prices throughout the West, but has changed the aspect of civilization. In England the catastrophe began with the passage of the Bank Act.

No sooner had this statute taken effect than it necessarily caused a contraction of the currency at a time when gold was rising because of commercial expansion. Between 1839 and 1849 there was a fall in prices of twenty-eight per cent, and, severe as may have been the decline, it seems moderate considering the conditions which then prevailed. The yield of the mines was scanty, and of this yield India absorbed annually an average of £2,308,000, or somewhat more than one-sixth.

America was growing with unprecedented vigor, industrial competition sharpened as prices fell, and the year of the “Bank Act “ was the year in which railway building began to take the form of a mania. The peasantry are always the weakest part of every population, and therefore agricultural prices are the most sensitive. But the resources of a peasantry are seldom large, and, as the value of their crops shrinks, the margin of profit on which they live dwindles, until they are left with only a bare subsistence in good years, and with famine facing them in bad. The Irish peasants were the weakest portion of the population of Great Britain when Lord Overstone became supreme, and when the potato crop failed in 1845 they starved.

Although the landlords had lost their command over the nation in 1688, they yet, down to the last administration of Peel, had kept strength enough to secure protection from Parliament against foreign competition. By 1815 the yeomanry had almost disappeared, the soil belonged to a few rich families whose revenue depended on rents, and the value of rents turned on the price of the cereals. To sustain the market for wheat became therefore all-important to the aristocracy, and when, with the peace, prices collapsed, they obtained a statute which prohibited imports until the bushel should fetch ten shillings at home.

This statute, though frequently amended to make it more effective, partially failed of its purpose. A contracting currency did its resistless work, prices dropped, tenants went bankrupt, and, as the value of money rose, encumbered estates passed more frequently into the hands of creditors. Thus when Peel took office in 1841, the Corn Laws were regarded by the gentry as their only hope, and Peel as their chosen champion; but only a few years elapsed before it became evident that the policy of Lombard Street must precipitate a struggle for life between the manufacturers and the landlords. In the famine of 1846 the decisive moment came, and when Sir Robert sided, as was his wont, with the strongest, and abandoned his followers to their fate, he only yielded to the impulsion of a resistless force.

As a class both landlords and manufacturers were debtors, and, by 1844, cheap bread appeared to be as vital to the one as dear corn was to the other. With a steadily falling market the manufacturers saw their margin of profit shrink, and at last Manchester and Birmingham believed themselves to be confronted with ruin unless wages fell proportionately, or they could broaden the market for their wares by means of international exchanges. The Corn Laws closed both avenues of relief; therefore there was war to the death between the manufacturers and the aristocracy. The savageness of the attack can be judged by Cobden’s jeers at gentlemen who admitted that free corn meant insolvency:

Sir Edward Knatchbull could not have made a better speech for the League than that which he made lately, even if he were paid for it. I roared so with laughter that he called me specially to order, and I begged his pardon, for he is the last man in the world I would offend, we are all so much obliged to him. He said they could not do without this Corn Law, because, if it were repealed, they could not pay the jointures, charged on their estates. Lord Mountcashel, too (he’s not over-sharp) said that one half the land was mortgaged, and they could not pay the interest unless they had a tax upon bread. In Lancashire, when a man gets into debt and can’t pay, he goes into the Gazette, and what is good for a manufacturer is, I think, good for a landlord.[27]

In such a contest the gentry were overmatched, for they were but nature’s first effort toward creating the economic type, and they were pitted against later forms which had long distanced them in the competition of life. Bright and Cobden, as well as Loyd and Peel, belonged to a race which had been driven into trade, by the loss of their freeholds to the fortunate ancestors of the men who lay at their mercy in 1846. Peel himself was the son of a cotton-spinner, and the grandson of a yeoman, who, only in middle life, had quitted his hand-loom to make his fortune in the “industrial revolution.”

In modern England, as in ancient Italy, the weakest sank first, and the landed gentry succumbed, almost without resistance, to the combination which Lombard Street made against them. Yet, though the manufacturers seemed to triumph, their exultation was short, for the fate impended over them, even in the hour of their victory, which always overhangs the debtor when the currency has been seized by the creditor class. By the “Bank Act” the usurers became supreme, and in 1846 the potato crop failed even more completely than in 1845. Credit always is more sensitive in England than in France, because it rests upon a narrower basis, and at that moment it happened to be strained by excessive railway loans. With free trade in corn, large imports of wheat were made, which were paid for with gold. A drain set in upon the Bank, the reserve was depleted, and by October 2, 1847, the directors denied all further advances. Within three years of the passage of his statute, the event Loyd had foreseen arrived. “Monetary distress” began to force down prices. The decision of the directors to refuse discounts created “a great excitement on the Stock Exchange. The town and country bankers hastened to sell their public securities, to convert them into money. The difference between the price of consols for ready money and for the account of the 14th of October showed a rate of interest equivalent to 50 per cent per annum. Exchequer bills were sold at 35s. discount.” . . . “A complete cessation of private discounts followed. No one would part with the money or notes in his possession. The most exorbitant sums were offered to and refused by merchants for their acceptances.”[28]

Additional gold could only be looked for from abroad, and as a considerable time must elapse before specie could arrive in sufficient quantity to give relief, the currency actually in use offered the only means of obtaining legal tender for the payment of debts. Consequently hoarding became general, and, as the chancellor of the exchequer afterward observed, “an amount of circulation which, under ordinary circumstances, would have been adequate, became insufficient for the wants of the community.” Boxes of gold and bank-notes in “thousands and tens of thousands of pounds” were “deposited with bankers.” The merchants, the chancellor said, begged for notes: “Let us have notes; . . . we don’t care what the rate of interest is. . . . Only tell us that we can get them, and this will at once restore confidence.”[29]

But, after October 2, no notes were to be had, money was a commodity without price, and had the policy of the “Bank Act” been rigorously maintained, English debtors, whose obligations then matured, must have forfeited their property, since credit had ceased to exist and currency could not be obtained wherewith to redeem their pledges.

The instinct of the usurer has, however, never been to ruin suddenly the community in which he has lived: only by degrees does he exhaust human vitality. Therefore, when the great capitalists had satisfied their appetites, they gave relief. From the 2d to the 25th of October, contraction was allowed to do its work; then Overstone intervened, the government was instructed to suspend the “act,” and the community was promised all the currency it might require.

The effect was instantaneous. The letter from the cabinet, signed by Lord John Russell, which recommended the directors of the Bank to increase their discounts, “was made public about one o’clock on Monday, the 25th, and no sooner was it done so than the panic vanished like a dream! Mr. Gurney stated that it produced its effect in ten minutes! No sooner was it known that notes might be had, than the want of them ceased!”[30] Large parcels of notes were “returned to the Bank of England cut into halves, as they had been sent down into the country.”

The story of this crisis demonstrates that, by 1844, the money-lenders had become autocratic in London. The ministry were naturally unwilling to suspend a statute which had just been enacted, and the blow to Sir Robert peculiarly severe; but the position of the government admitted of no alternative. At the time it was said that the private bankers of London intimated to the chancellor of the exchequer that, unless he interfered forthwith, they would withdraw their balances from the Bank of England. This meant insolvency, and to such an argument there was no reply. But whether matters actually went so far or not, there can be no question that the cabinet acted under the dictation of Lombard Street, for the chancellor of the exchequer defended his policy by declaring that the “act” had not been suspended until “those conversant with commercial affairs, and least likely to decide in favor of the course which we ultimately adopted,” unanimously advised that relief should be given to the mercantile community.[31]

There was extreme suffering throughout the country, which manifested itself in all the well-known ways. The revenue fell off, emigration increased, wheat brought but about five shillings the bushel, while in England and Wales alone there were upwards of nine hundred thousand paupers. Discontent took the form of Chartism, and a revolution seemed imminent. Nor was it Great Britain only which was convulsed: all Europe was shaken to its center, and everything portended some dire convulsion, when nature intervened and poured upon the world a stream of treasure too bountiful to be at once controlled.

In 1849 the first Californian gold reached Liverpool. In four years the supply of the precious metals trebled, prices rose, crops sold again at a profit. As the farmers grew rich, the demand for manufactures quickened, wages advanced, discontent vanished, and though values never again reached the altitude of 1809, they at least attained that level of substantial prosperity which preceded the French Revolution. Nevertheless, the fall in the purchasing power of money, and the consequent ability of debtors to meet their obligations, did not excite that universal joy which had thrilled Europe at the discovery of Potosi, for a profound change had passed over society since the buccaneers laid the foundations of England’s fortune by the plunder of the Peruvian galleons.

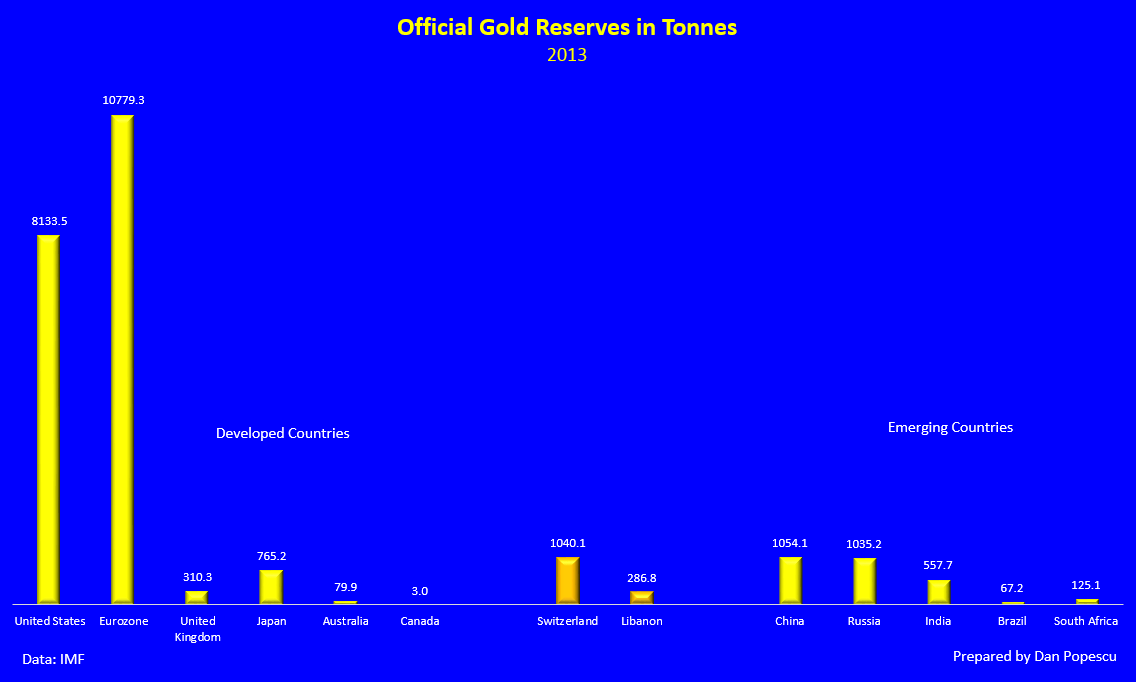

To the type of mind which predominated after 1810, the permanent rise of commodities relatively to money was unwelcome, and, almost from the opening of the gold discoveries, a subtle but resistless force was working for contraction—a force which first showed itself in the movement for an uniform gold coinage, and afterwards in general gold monometallism. The great change came with the conquest of France by Germany. Until after the middle of the nineteenth century, Germany held only a secondary position in the economic system of Europe, because of her poverty. With few harbors, she had reaped little advantage from the plunder of America and India, exchanges had never centered within her borders, and her accumulated capital had not sufficed to stimulate high consolidation. The conquest of France suddenly transformed these conditions. In 1871 she acquired an enormous booty, and the effect upon her was akin to the effect on England of the confiscations in Bengal; the chief difference being that, unlike England, Germany passed almost immediately into the period of contraction.

The spoliation of India went on for twenty years, that of France was finished in a few months, and, while in England the “industrial revolution” intervened between Plassey and the adoption of the gold standard, in Germany the bankers dominated from the outset. The government belonged to the class which desired an appreciating currency, and in 1873 the new empire followed in the steps of Lombard Street, and demonetized silver.

Germany’s action was decisive. Restrictions were placed on the mints of the Latin Union and of the United States, and thus, by degrees, the whole stress of the trade of the West was transferred from the old composite currency to gold alone. In this way, not only was the basis of credit in the chief commercial states cut in half, but the annual supply of metal for coinage was diminished. In 1893 the gold mined fell nearly nine per cent short of the value of the gold and silver produced in 1865, and yet, during those twenty-eight years, the demand for money must have increased enormously, if it in any degree corresponded with the growth of trade.

The phenomena which followed the adoption of the gold standard by Western countries were precisely those which had been anticipated by Loyd. Lord Overstone had explained them to an earlier generation. In one of his letters on the “Bank Charter,” as early as 1855, he developed the whole policy of the usurers:

If a country increases in population, in wealth, in enterprise, and activity, more circulating medium will probably be required to conduct its extended transactions. This demand for increased circulation will raise the value of the existing circulation; it will become more scarce and more valuable, . . . in other words—gold will rise. . . .[32]

By the action of Germany, Overstone’s policy was extended to the whole Western world, with the results he had foreseen. Gold appreciated, until it acquired a purchasing power unequalled since the Middle Ages, and while in the silver-using countries prices remained substantially unchanged and the producers accordingly prospered, prostration supervened in Europe, the United States, and Australia. As usual the rural population suffered most, and the English aristocracy, who had been respited by the gold discoveries, were the first to succumb. They not only drew their revenues from farming land, but, standing at the focus of competition, they were exposed to the pressure of Asia and America alike. The harvest of 1879 was one of the worst of the century, land depreciated hopelessly, and that year may probably be taken as marking the downfall of a class which had maintained itself in opulence for nearly three hundred and fifty years.

This Tudor aristocracy, which sprang up at the Reformation, was one of the first effects of the quickened movement which transferred the center of exchanges from Italy to the North Sea. They represented sharpening economic competition, and they prospered because of an intellectual gift, an aptitude they enjoyed, of absorbing the lands of the priests and soldiers amidst whom they dwelt. These soldiers were the yeomen who, when evicted, became pirates, slavers, commercial adventurers, religious colonists, and conquerors, and who together poured the flood of treasure into London which, transmuted into movement, made the “industrial revolution.” When by their efforts, toward the beginning of the nineteenth century, sufficiently vast reservoirs of energy in the shape of money had accumulated, a new race rose to prominence, fitted to give vent to this force—men like Nathan Rothschild and Samuel Loyd, probably endowed with a subtler intellect and a keener vision than any who had preceded them, financiers beside whom the usurers of Byzantium, or the nobles of Henry VIII, were pigmies.

These bankers conceived a policy unrivaled in brilliancy, which made them masters of all commerce, industry, and trade. They engrossed the gold of the world, and then, by legislation, made it the sole measure of values. What Samuel Loyd and his followers did to England, in 1847, became possible for his successors to do to all the gold standard nations, after 1873. When the mints had been closed to silver, the currency being inelastic, the value of money could be manipulated like that of any article limited in quantity, and thus the human race became the subjects of the new aristocracy, which represented the stored energy of mankind.

From the moment this aristocracy has determined on a policy, as, for example the “Bank Act” or monometallism, resistance by producers becomes most difficult. Being debtors, producers are destroyed when credit is withdrawn, and, at the first signs of insubordination, the bankers draw in their gold, contract their loans, and precipitate a panic. Then, to escape immediate ruin, the debtor yields.

Since 1873 prices have generally fallen, and the mortgage has tended to engulf the pledge; but, from time to time the creditor class feels the need of turning the property it has acquired from bankrupts into gold, and then the rise explained by Overstone takes place. The hoards are opened, credit is freely given, the quantity of currency is increased, values rise, sales are made, and new adventurers contract fresh obligations. Then this expansion is followed by a fresh contraction, and liquidation is repeated on an ever-descending scale.

For many years farming land has fallen throughout the West, as it fell in Italy in the time of Pliny. Everywhere, as under Trajan, the peasantry are distressed; everywhere they migrate to the cities, as they did when Rome repudiated the denarius. By the census of the United Kingdom taken in 1891, not only did it appear that over seventy-one per cent of the inhabitants of England and Wales lived in towns, but that, while the urban districts had increased above fifteen per cent since the last census, the population of the purely agricultural counties had diminished.[33]

Moreover, within a generation, there has been a marked loss of fecundity among the more costly races. The rate of increase of the population has diminished. In the United States it is generally believed that the old native American blood is hardly reproducing itself; but, in all social phenomena, France precedes other nations by at least a quarter of a century, and it is, therefore, in France that the failure of vitality is most plainly seen. In 1789 the average French family consisted of 4.2 children. In 1891 it had fallen to 2.1,[34] and, since 1890, the deaths seem to have equaled the births.[35] In 1889 legislation was attempted to encourage productiveness, and parents of seven children were exempted from certain classes of taxes, but the experiment failed. Levasseur, in his great work on the population of France, has expressed himself almost in the words of Tacitus: “It can be laid down as a general law that, if in such a social condition as that of the French of the nineteenth century, the number of children is small, it is because the majority of parents wish it should be small.”[36]

Such signs point to the climax of consolidation. And yet, even the rise of the bankers is not the only or the surest indication that centralization is culminating. The destruction, wrought by accelerated movement, of the less tenacious organisms, is more evident below than above, is more striking in the advance of cheap labor, than in the evolution of the financier.

Notes

1. History of the Cotton Manufacture, 115.

2. A Tour Thro’ the whole Island of Great Britain, ed. 1753, iii, 136, 137.

3. Lives of Boulton and Watt, Smiles, 484.

4. First Letter on a Regicide Peace.

5. Theory and Practice of Banking, i, 507.

6. Considerations of the Lowering of Interests, Works, ed. 1823, v, 49.<

7. The Rothschilds, Reeves, 51.

8. The Rothschilds, Reeves, 192, 199.

9. Ibid., 200.

10. Wherever reference is made to comparative prices of commodities, the authority used has been the tables published by W. S. Jevons in Investigations in Currency and Finance, 144.

11. Ruding, Annals of the Coinage, iv, 37.

12. Overstone Tracts, 49.

13. History of Prices, i, 158.

14. Political Life of Sir Robert Peel, Doubleday, i, 218, note.

15. Theory and Practice of Banking, Macleod, ed. 1893, ii, 103.

16. See Hansard, New Series, viii, 189.

17. History of the Bank of England, i, 348.

18. Ibid., 347.

19. History of the Currency, MacLaren, 161.

20. Theory and Practice of Banking, Macleod, ii, 117, 118.

21. Overstone Tracts, 325.

22. Ibid., 191.

23. Ibid., 318.

24. Theory and Practice of Banking, ii, 147.

25. Overstone Tracts, 573.

26. Overstone Tracts, 574.

27. Cobden and the League, Ashworth, 174.

28. Theory and Practice of Banking, Macleod, ii, 169, 170.

29. Hansard, Third Series, xcv, 399.

30. Theory and Practice of Banking, ii, 170.

31. Hansard, Third Series, xcv, 398.

32. Overstone Tracts, 319.

33. See Journal of the Royal Statistical Society, liv, 464.

34. Dénombrement de 1891, 261.

35. Annuaire de L’Economie Politique, 1894, Block, 18.

36. La Population Française, ii, 214.

Beaucoup, beaucoup trop d'années se sont écoulées depuis que Marco Cochi - un grand africaniste et surtout un ami inoubliable - a écrit son « Afrique. Le continent oublié ». Un ouvrage aujourd'hui presque introuvable, mais qui devrait être réédité et surtout relu. Avec beaucoup d'attention.

Beaucoup, beaucoup trop d'années se sont écoulées depuis que Marco Cochi - un grand africaniste et surtout un ami inoubliable - a écrit son « Afrique. Le continent oublié ». Un ouvrage aujourd'hui presque introuvable, mais qui devrait être réédité et surtout relu. Avec beaucoup d'attention.

del.icio.us

del.icio.us

Digg

Digg

Wer gegen die Verordnung verstieß und sein Gold trotz Verpflichtung nicht an den Staat verkaufte, musste mit einer Geldstrafe von bis zu 10.000 US-Dollar (nach heutigem Wert rund 200.000 Dollar) bzw. einer Haftstrafe rechnen, die in schweren Fällen zehn Jahre betragen konnte. Gold im Wert von über Einhundert Dollar (beim festgelegten Ankaufspreis von 20,67 Dollar also etwa 5 Unzen), welches die Polizei bei Durchsuchungen sicherstellte, wurde entschädigungslos beschlagnahmt.

Wer gegen die Verordnung verstieß und sein Gold trotz Verpflichtung nicht an den Staat verkaufte, musste mit einer Geldstrafe von bis zu 10.000 US-Dollar (nach heutigem Wert rund 200.000 Dollar) bzw. einer Haftstrafe rechnen, die in schweren Fällen zehn Jahre betragen konnte. Gold im Wert von über Einhundert Dollar (beim festgelegten Ankaufspreis von 20,67 Dollar also etwa 5 Unzen), welches die Polizei bei Durchsuchungen sicherstellte, wurde entschädigungslos beschlagnahmt. Es war US-Präsident Richard Nixon, der dem Goldstandard knapp 40 Jahre später endgültig den Garaus machte. Am 15. August 1971 hob Nixon die Goldbindung des US-Dollar und damit den Goldstandard auf. Hintergrund war der rasant wachsende Welthandel, der den teilweise goldgedeckten Dollar als Ankerwährung überforderte, aber auch die hohen Kosten des Vietnamkrieges, der die Vereinigten Staaten auch finanziell stark belastete. Nixon versprach seinen Landsleuten, dass der Dollar nach dem Ende des Goldstandards seinen Wert behalten werde. Das hingegen erwies sich als falsch. Nach dem amtlichen Verbraucherindex hat der US-Dollar seit 1971 mehr als 80 Prozent seiner Kaufkraft eingebüßt. Das spiegelt sich auch im Goldpreis wieder, der von 35 Dollar auf aktuell 1.650 Dollar anstieg, ein Zuwachs um mehr als 4.600 Prozent!

Es war US-Präsident Richard Nixon, der dem Goldstandard knapp 40 Jahre später endgültig den Garaus machte. Am 15. August 1971 hob Nixon die Goldbindung des US-Dollar und damit den Goldstandard auf. Hintergrund war der rasant wachsende Welthandel, der den teilweise goldgedeckten Dollar als Ankerwährung überforderte, aber auch die hohen Kosten des Vietnamkrieges, der die Vereinigten Staaten auch finanziell stark belastete. Nixon versprach seinen Landsleuten, dass der Dollar nach dem Ende des Goldstandards seinen Wert behalten werde. Das hingegen erwies sich als falsch. Nach dem amtlichen Verbraucherindex hat der US-Dollar seit 1971 mehr als 80 Prozent seiner Kaufkraft eingebüßt. Das spiegelt sich auch im Goldpreis wieder, der von 35 Dollar auf aktuell 1.650 Dollar anstieg, ein Zuwachs um mehr als 4.600 Prozent!

On November 30th, voters in Switzerland will head to the polls to vote in a referendum on gold. On the ballot is a measure to prohibit the Swiss National Bank (SNB) from further gold sales, to repatriate Swiss-owned gold to Switzerland, and to mandate that gold make up at least 20 percent of the SNB’s assets. Arising from popular sentiment similar to movements in the United States, Germany, and the Netherlands, this referendum is an attempt to bring more oversight and accountability to the SNB, Switzerland’s central bank.

On November 30th, voters in Switzerland will head to the polls to vote in a referendum on gold. On the ballot is a measure to prohibit the Swiss National Bank (SNB) from further gold sales, to repatriate Swiss-owned gold to Switzerland, and to mandate that gold make up at least 20 percent of the SNB’s assets. Arising from popular sentiment similar to movements in the United States, Germany, and the Netherlands, this referendum is an attempt to bring more oversight and accountability to the SNB, Switzerland’s central bank. The US has used its court system to extort money from Switzerland, fining the US subsidiaries of Swiss banks for allegedly sheltering US taxpayers and allowing them to keep their accounts and earnings hidden from US tax authorities. EU countries such as Germany have even gone so far as to purchase account information stolen from Swiss banks by unscrupulous bank employees. And with the recent implementation of the Foreign Account Tax Compliance Act (FATCA), Swiss banks will now be forced to divulge to the IRS all the information they have about customers liable to pay US taxes.

The US has used its court system to extort money from Switzerland, fining the US subsidiaries of Swiss banks for allegedly sheltering US taxpayers and allowing them to keep their accounts and earnings hidden from US tax authorities. EU countries such as Germany have even gone so far as to purchase account information stolen from Swiss banks by unscrupulous bank employees. And with the recent implementation of the Foreign Account Tax Compliance Act (FATCA), Swiss banks will now be forced to divulge to the IRS all the information they have about customers liable to pay US taxes.

In discussing the phenomena of the highly centralized society in which he lived, Mill defined capital “as the accumulated stock of human labor.” In other words, capital may be considered as stored energy; but most of this energy flows in fixed channels, money alone is capable of being transmuted immediately into any form of activity. Therefore the influx of the Indian treasure, by adding considerably to the nation’s cash capital, not only increased its stock of energy, but added much to its flexibility and the rapidity of its movement.

In discussing the phenomena of the highly centralized society in which he lived, Mill defined capital “as the accumulated stock of human labor.” In other words, capital may be considered as stored energy; but most of this energy flows in fixed channels, money alone is capable of being transmuted immediately into any form of activity. Therefore the influx of the Indian treasure, by adding considerably to the nation’s cash capital, not only increased its stock of energy, but added much to its flexibility and the rapidity of its movement. Deutschlands Goldreserven an USA verpfändet?

Deutschlands Goldreserven an USA verpfändet?