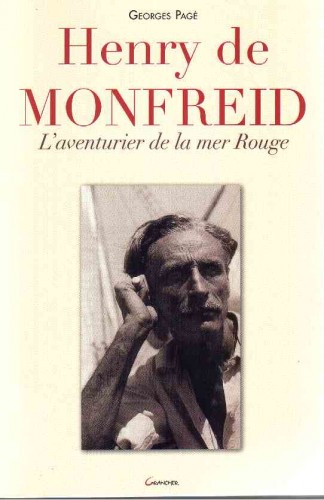

Di Henry De Monfreid in Italia si sa poco o niente e sono scarse le traduzioni, disponibili tra l'altro solo da qualche anno. «L'ultimo vero filibustiere della letteratura europea» lo ha invece definito Stenio Solinas. «Ho avuto una ricca, irrequieta e magnifica» dichiarò lo scrittore alcuni giorni prima di morire all'età di 95 anni nel 1974. Prima che autore fu uomo di mare e d'avventure e iniziò a scrivere passati i cinquant'anni. Una seconda vita la sua, quella da scrittore. Anzi la terza. Perchè quando nasce, a La Franqui-Leucate (Aude), sulla costa mediterranea il 14 novembre 1879, c'è solo il mare a presagire che tipo di vita sceglierà.

Di Henry De Monfreid in Italia si sa poco o niente e sono scarse le traduzioni, disponibili tra l'altro solo da qualche anno. «L'ultimo vero filibustiere della letteratura europea» lo ha invece definito Stenio Solinas. «Ho avuto una ricca, irrequieta e magnifica» dichiarò lo scrittore alcuni giorni prima di morire all'età di 95 anni nel 1974. Prima che autore fu uomo di mare e d'avventure e iniziò a scrivere passati i cinquant'anni. Una seconda vita la sua, quella da scrittore. Anzi la terza. Perchè quando nasce, a La Franqui-Leucate (Aude), sulla costa mediterranea il 14 novembre 1879, c'è solo il mare a presagire che tipo di vita sceglierà. In the 1990s he delighted eurosceptics by his opposition, almost unique among French economists, to the single European currency; europhobes were less enthused when he revealed that he was against it because the currency's introduction should have been preceded by wholesale European political union.

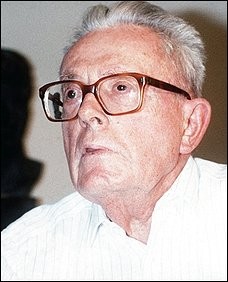

He had won his Nobel for Economics in 1988. But he might also have been a candidate for the award in Physics, a discipline in which he was best known for his discovery that Earth's gravitational pull appears to increase during a solar eclipse.

Fluctuations have since been measured during 20 or so total solar eclipses, but the results remain inconclusive, and the "Allais effect", as it is known, continues to confound scientists. Allais himself had little doubt that the effect indicated a flaw in Einstein's theory of relativity. Indeed, he had little time for Einstein who, he claimed, had plagiarised the work of earlier scientists such as Lorentz and Poincaré in his 1905 papers on special relativity and E=mc2.

As an economist, Allais had reason to complain that others had been given credit that was his due. In his first major work, A la Recherche d'une Discipline Economique (1943), he proved mathematically that an efficient market could be achieved through a system of equilibrium pricing (when prices create a balance in demand with what can be supplied).

It proved vital in guiding the investment and pricing decisions made by younger economists working for the state-owned monopolies that proliferated in Western Europe after the Second World War – and for the authorities regulating private sector monopolies in an age of denationalisation.

He was awarded the Nobel for his "pioneering contributions to the theory of markets and efficient utilisation of resources", but the award was late in coming. His work has been compared favourably with that carried out at the same time or later by the American Paul Samuelson and the British economist John Hicks, both of whom won Nobel Prizes in the 1970s. Allais's work also served as a basis for the analysis of markets and social efficiency carried out by one of his former pupils, Gerard Debreu, who won the Nobel Economics Prize in 1983 after he became an American citizen, and Kenneth Arrow, who won the prize in 1972.

The main reason why Allais was overlooked for so long appears to be that he did not publish in English until late in his career and as a result did not gain the international recognition that was his due. Paul Samuelson felt that, had Allais's early works been in English, "a generation of economic theory would have taken a different course".

The son of a cheese shop owner, Maurice Allais was born in Paris on May 11 1911. After his father died in captivity during the First World War, he was raised by his mother in reduced circumstances.

A brilliant student at the Lycée Louis-le-Grand, Allais trained as an engineer at the Ecole Polytechnique and worked for several years as a mining engineer. He turned to economics after being appalled by the suffering he saw during a visit to the United States during the Great Depression. He taught himself the subject and soon began to teach it at the Ecole Nationale Supérieure des Mines de Paris, introducing a mathematical rigour into the French discipline, which at that time was mostly non-quantitative.

Allais's most important contributions to economic theory were formulated during the Second World War, when French academics, working under German occupation, were largely cut off from the outside world.

John Hicks, one of the first Allied economists in Paris after the liberation, recalled making his way to an attic where, once his eyes had adjusted to the dark, he could see a group with miners' lamps on their heads listening to a lecturer at a board. The lecturer was Allais, and he was talking about whether the interest rate should be zero per cent in a no-growth economy. This foreshadowed his second major publication, Economie et Intérêt (1947), a massive work on capital and interest which has formed the basis for the so-called "golden rule of accumulation". This states that to maximise real income, the optimum rate of interest should equal the growth rate of the economy.

Allais's book also included the suggestion that in stimulating an economy it is helpful to use a simple model consisting of two generations, young and old. At each step, the old generation dies, the young generation grows old, and a new young generation appears. The model, now known as the overlapping generations model, got little attention at the time, but more than a decade later Paul Samuelson introduced the same idea independently.

Allais's work had more than theoretical importance. When France rebuilt its economy on a combination of state dirigisme and market economics, Allais provided the theoretical framework needed to allow planners to resist the short-termism of politicians and set optimum pricing and investment strategies.

During the 1950s he pioneered a new approach when, in examining how people respond to economic stimuli, he asked a group to choose among certain gambles, and then examined their decisions. He discovered that the subjects acted in ways that were inconsistent with the standard theory of utility, which predicts that people will behave as rational economic beings. As a result he created the "Allais Paradox", an equation that predicts responses to risk.

Allais, who served as director of research at the National French Research Council, remained active and independent-minded until well into his eighties. Shortly before the stock market crash of 1987 he wrote a paper warning that the situation presented "three fundamental analogies with that which preceded the Great Depression of 1929-1934: a great development of promises to pay, frenetic speculation, and a resulting potential instability in credit mechanisms, that is, financing long-term investments with short-term deposits."

In 1989 he warned that Wall Street had become a "veritable casino", with loose credit practices, insufficient margin requirements and computerised trading on a non-stop world market – all contributing to a dangerously volatile financial climate.

In a recent article he argued that a "rational protectionism between countries with very different living standards is not only justified but absolutely necessary".

Allais was a prolific writer, both in the length of his pieces (his books typically ran to 800 or 900 pages) and in the variety of subjects he addressed. As well as works on economic theory and physics, he also wrote books on history.

Maurice Allais was appointed an officer of the Légion d'honneur in 1977 and grand officer in 2005. He was promoted to Grand Cross of the Légion d'honneur earlier this year.

His wife, Jacqueline, died in 2003, and he is survived by their daughter.

del.icio.us

del.icio.us

Digg

Digg The collapse of communism in Central and Eastern Europe produced a fundamental change in the political map of Europe. In Romania, nationalism re-emerged forcefully and continued to rally political support against the context of a long and difficult transition to democracy. Extreme right-wing party The Greater Romania Party gained particular strength as a major political power, and its persuasive appeal rested on a reiteration of nationalism and identity - and themes such as origins, historical continuity, leadership, morality and religion - that had been embedded in Romanian ideological discourse by earlier nationalist formations. Radu Cinpoes here examines the reasons for the strength and resilience of nationalism in Romania, from the formation of the state to its accession in the EU.

The collapse of communism in Central and Eastern Europe produced a fundamental change in the political map of Europe. In Romania, nationalism re-emerged forcefully and continued to rally political support against the context of a long and difficult transition to democracy. Extreme right-wing party The Greater Romania Party gained particular strength as a major political power, and its persuasive appeal rested on a reiteration of nationalism and identity - and themes such as origins, historical continuity, leadership, morality and religion - that had been embedded in Romanian ideological discourse by earlier nationalist formations. Radu Cinpoes here examines the reasons for the strength and resilience of nationalism in Romania, from the formation of the state to its accession in the EU.

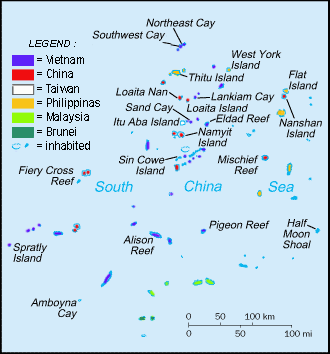

Pendant deux ans, la Chine et le Japon s’étaient efforcés de provoquer un dégel dans leurs relations auparavant fort chargées de contentieux. Cette période connaît désormais sa fin. Il y a à peu près trois semaines, un bateau de pêcheurs chinois en train de prendre du thon a heurté deux patrouilleurs côtiers japonais à proximité des petites îles rocheuses Sentaku (en chinois : Diaoyu), dont les eaux avoisinantes sont revendiquées tant par la Chine que par le Japon. Les Japonais ont rapidement relâché les quatorze marins de l’équipage mais maintenu en détention le capitaine vindicatif, un certain Zhang Qixiong. Début octobre, il se trouvait encore en détention préventive.

Pendant deux ans, la Chine et le Japon s’étaient efforcés de provoquer un dégel dans leurs relations auparavant fort chargées de contentieux. Cette période connaît désormais sa fin. Il y a à peu près trois semaines, un bateau de pêcheurs chinois en train de prendre du thon a heurté deux patrouilleurs côtiers japonais à proximité des petites îles rocheuses Sentaku (en chinois : Diaoyu), dont les eaux avoisinantes sont revendiquées tant par la Chine que par le Japon. Les Japonais ont rapidement relâché les quatorze marins de l’équipage mais maintenu en détention le capitaine vindicatif, un certain Zhang Qixiong. Début octobre, il se trouvait encore en détention préventive.

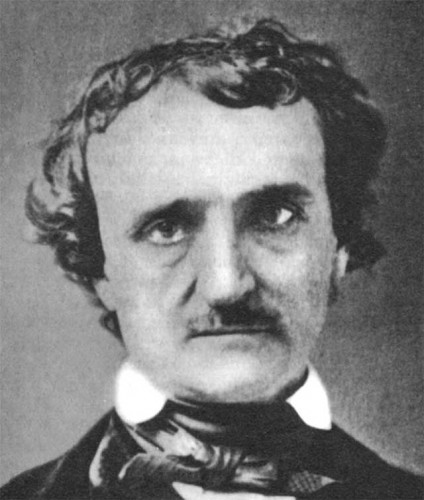

Per Edgar Allan Poe sono gli anni migliori. Ottiene buoni risultati nella sua carriera di giornalista e soprattutto comincia a pubblicare con un certo successo i romanzi e racconti che lo renderanno universalmente famoso. Fra il 1837 e 1838 scrive la “Storia di Arthur Gordon Pym”, un romanzo che secondo il critico Gianfranco De Turris prosegue e riprende un’antica tradizione narrativa (con riferimento ad autori come Coleridge, Swift, Cooper), nella quale sono presenti immagini che si ripetono varie volte: il viaggio per mare, la caduta nell’abisso, le tempeste ed i naufragi che colpiscono i protagonisti, la fame e la pratica del cannibalismo, l’esplorazione di terre sconosciute e il contatto con nuove genti indigene. Tutte queste immagini devono essere considerate anche come elementi di un duro itinerario iniziatico del protagonista che, attraversando l’esperienza del dolore, della morte e della resurrezione, assurge nel finale ad una più sublime e superiore dimensione dell’Essere.

Per Edgar Allan Poe sono gli anni migliori. Ottiene buoni risultati nella sua carriera di giornalista e soprattutto comincia a pubblicare con un certo successo i romanzi e racconti che lo renderanno universalmente famoso. Fra il 1837 e 1838 scrive la “Storia di Arthur Gordon Pym”, un romanzo che secondo il critico Gianfranco De Turris prosegue e riprende un’antica tradizione narrativa (con riferimento ad autori come Coleridge, Swift, Cooper), nella quale sono presenti immagini che si ripetono varie volte: il viaggio per mare, la caduta nell’abisso, le tempeste ed i naufragi che colpiscono i protagonisti, la fame e la pratica del cannibalismo, l’esplorazione di terre sconosciute e il contatto con nuove genti indigene. Tutte queste immagini devono essere considerate anche come elementi di un duro itinerario iniziatico del protagonista che, attraversando l’esperienza del dolore, della morte e della resurrezione, assurge nel finale ad una più sublime e superiore dimensione dell’Essere.

En France, pense-t-on sérieusement à annexer la Wallonie, et même Bruxelles, à la « mère-patrie » hexagonale ? Oui, si l’on croit ce qu’écrivent certains sites sur Internet ou certains journaux. Ainsi, le ministre français des affaires européennes, Pierre Lellouche, se serait exprimé ouvertement, lors d’une réunion, sur les effets positifs qu’aurait une réception de la Wallonie dans le giron de Mère-France. La question demeure ouverte : quel est le degré de réalisme de tels plans ? Quel zèle déploient donc

En France, pense-t-on sérieusement à annexer la Wallonie, et même Bruxelles, à la « mère-patrie » hexagonale ? Oui, si l’on croit ce qu’écrivent certains sites sur Internet ou certains journaux. Ainsi, le ministre français des affaires européennes, Pierre Lellouche, se serait exprimé ouvertement, lors d’une réunion, sur les effets positifs qu’aurait une réception de la Wallonie dans le giron de Mère-France. La question demeure ouverte : quel est le degré de réalisme de tels plans ? Quel zèle déploient donc

N.S.

N.S. Così, nel sembrare un pessimista di natura, cerca nei suoi personaggi la chiave per descrivere l’uomo che cade in piedi. Che non è semplice, perché se cadi il segno di un livido ti rimane, cadendo e rimanendo in piedi il dolore lo senti solo dentro. Non è fisico, è solo mentale. Alfonso Nitti, bancario che lascia la mamma e si ritrova in una città che non sembra appartenergli, a cui non vuole appartenere, il personaggio di Una vita ricalca l’archetipo del debole, di colui che si arrende all’amore perché non è amato dalla donna che vorrebbe, che si arrende alla perfezione e alla cura estetica del collega che lo snerva nel suo essere borghese e arrivista, si arrende alla distanza inevitabile del suo capo, il Maller. Solo la morte per quanto crudele e distante, riuscirà ad avvicinarlo alla perfezione della vita, ma questo nemmeno servirà ad sentire più vicini quelli che lui considerava mal volentieri “colleghi”."La Banca Maller, in puro stile burocratico, annuncia un funerale che avviene con l’intervento dei colleghi e della direzione" (Una vita). Alfonso, che si dà colpe non sue, scriverà alla mamma: “Non credere, mamma, che qui si stia tanto male; sono io che ci sto male”. Non faceva nulla e quel nulla lo portava ad avere un’inerzia totale dinnanzi alle cose. Non era stanco, era solo annoiato. Tutti i giorni lì su quella sedia, tutti i giorni a subire e non capire, tutti i giorni un pezzo di vita che si vedeva portar via, ma la cosa assurda è che mentre gli altri “sembravano” contenti di vivere così, Alfonso era contento di non vivere. Avrà ragione Joyce a dire che nella penna di un uomo c’è un solo romanzo e che quando se ne scrivono diversi si tratta sempre del medesimo più o meno trasformato. Così da Una Vita si passa alla Coscienza di Zeno, che nel 1924 Svevo spedisce al suo ormai amico Joyce, trasferitosi a Trieste e suo professore di inglese che Livia Veneziani Svevo descriverà così: “Fra il maestro, oltremodo irregolare, ma d’altissimo ingegno e lo scolaro d’eccezione le lezioni si svolgevano con un andamento fuori dal comune”. Joyce, entusiasta del suo “allievo”, fa conoscere il manoscritto in Francia dove verrà pubblicato. In Italia sarà per merito di Eugenio Montale, sulle pagine della rivista L’Esame, che Svevo riuscirà ad avere la prima notorietà. Zeno Cosini che cerca di guarire da una malattia non ancora ben definita ed inizia il percorso psicoanalitico presso il Dottor S. Dottore che, per quanto poco si sforzi di capire il problema, non riuscirà a farlo e nel momento dell’abbandono della terapia da parte di Zeno si vendicherà pubblicando le memorie del suo paziente con la speranza che questo gli procuri dolore. Ma Zeno, che è più impegnato ad amare la sua sigaretta non farà altro che ridere e deridere il suo analista.

Così, nel sembrare un pessimista di natura, cerca nei suoi personaggi la chiave per descrivere l’uomo che cade in piedi. Che non è semplice, perché se cadi il segno di un livido ti rimane, cadendo e rimanendo in piedi il dolore lo senti solo dentro. Non è fisico, è solo mentale. Alfonso Nitti, bancario che lascia la mamma e si ritrova in una città che non sembra appartenergli, a cui non vuole appartenere, il personaggio di Una vita ricalca l’archetipo del debole, di colui che si arrende all’amore perché non è amato dalla donna che vorrebbe, che si arrende alla perfezione e alla cura estetica del collega che lo snerva nel suo essere borghese e arrivista, si arrende alla distanza inevitabile del suo capo, il Maller. Solo la morte per quanto crudele e distante, riuscirà ad avvicinarlo alla perfezione della vita, ma questo nemmeno servirà ad sentire più vicini quelli che lui considerava mal volentieri “colleghi”."La Banca Maller, in puro stile burocratico, annuncia un funerale che avviene con l’intervento dei colleghi e della direzione" (Una vita). Alfonso, che si dà colpe non sue, scriverà alla mamma: “Non credere, mamma, che qui si stia tanto male; sono io che ci sto male”. Non faceva nulla e quel nulla lo portava ad avere un’inerzia totale dinnanzi alle cose. Non era stanco, era solo annoiato. Tutti i giorni lì su quella sedia, tutti i giorni a subire e non capire, tutti i giorni un pezzo di vita che si vedeva portar via, ma la cosa assurda è che mentre gli altri “sembravano” contenti di vivere così, Alfonso era contento di non vivere. Avrà ragione Joyce a dire che nella penna di un uomo c’è un solo romanzo e che quando se ne scrivono diversi si tratta sempre del medesimo più o meno trasformato. Così da Una Vita si passa alla Coscienza di Zeno, che nel 1924 Svevo spedisce al suo ormai amico Joyce, trasferitosi a Trieste e suo professore di inglese che Livia Veneziani Svevo descriverà così: “Fra il maestro, oltremodo irregolare, ma d’altissimo ingegno e lo scolaro d’eccezione le lezioni si svolgevano con un andamento fuori dal comune”. Joyce, entusiasta del suo “allievo”, fa conoscere il manoscritto in Francia dove verrà pubblicato. In Italia sarà per merito di Eugenio Montale, sulle pagine della rivista L’Esame, che Svevo riuscirà ad avere la prima notorietà. Zeno Cosini che cerca di guarire da una malattia non ancora ben definita ed inizia il percorso psicoanalitico presso il Dottor S. Dottore che, per quanto poco si sforzi di capire il problema, non riuscirà a farlo e nel momento dell’abbandono della terapia da parte di Zeno si vendicherà pubblicando le memorie del suo paziente con la speranza che questo gli procuri dolore. Ma Zeno, che è più impegnato ad amare la sua sigaretta non farà altro che ridere e deridere il suo analista. Stupida come cosa, ma immediatamente riuscii a capire il veleno che ti attraversa le vene, riuscii a capire quanto sia debole un uomo dinnanzi ad un vizio, che non ti serve, che non è utile, che è dannoso, ma diventa vitale. E più di tutto mi impressionò in Zeno il tentativo di voler smettere e la volontà certa di non farlo mai. Il medico della casa di cura dove venne “rinchiuso” per smettere di fumare gli dice:"Non capisco perché lei, invece di cessare di fumare, non si sia piuttosto risolto di diminuire il numero delle sigarette che fuma". Il non averci mai pensato di Zeno risulta l’immagine migliore del romanzo, il dolore che vivi dallo stacco brutale da un qualcosa a cui sei morbosamente legato ti ripaga dell’amore per cui morbosamente sei legato a quella cosa. Così o si rinuncia in maniera totale o non si rinuncia. Così Zeno passerà ogni sera ad annotare una U.S, un’ultima sigaretta mai spenta.

Stupida come cosa, ma immediatamente riuscii a capire il veleno che ti attraversa le vene, riuscii a capire quanto sia debole un uomo dinnanzi ad un vizio, che non ti serve, che non è utile, che è dannoso, ma diventa vitale. E più di tutto mi impressionò in Zeno il tentativo di voler smettere e la volontà certa di non farlo mai. Il medico della casa di cura dove venne “rinchiuso” per smettere di fumare gli dice:"Non capisco perché lei, invece di cessare di fumare, non si sia piuttosto risolto di diminuire il numero delle sigarette che fuma". Il non averci mai pensato di Zeno risulta l’immagine migliore del romanzo, il dolore che vivi dallo stacco brutale da un qualcosa a cui sei morbosamente legato ti ripaga dell’amore per cui morbosamente sei legato a quella cosa. Così o si rinuncia in maniera totale o non si rinuncia. Così Zeno passerà ogni sera ad annotare una U.S, un’ultima sigaretta mai spenta.

Le Premier ministre François Fillon a annoncé un gel en valeur des dépenses de l’État sur trois ans, une baisse de 10 % des dépenses de fonctionnement (entre 800 million et 900 millions d’euros) et 5 milliards d’économies sur les niches fiscales. Le non-remplacement d’un fonctionnaire sur deux est en outre confirmé. L’objectif est de ramener le déficit de 8 % du P.I.B. en 2010, à 6 % en 2011, 4,6 % en 2012, et 3 % en 2013, soit 95 milliards d’économies en trois ans. Or l’immigration extra-européenne coûte à elle seule 36 milliards d’euros par an à la France !

Le Premier ministre François Fillon a annoncé un gel en valeur des dépenses de l’État sur trois ans, une baisse de 10 % des dépenses de fonctionnement (entre 800 million et 900 millions d’euros) et 5 milliards d’économies sur les niches fiscales. Le non-remplacement d’un fonctionnaire sur deux est en outre confirmé. L’objectif est de ramener le déficit de 8 % du P.I.B. en 2010, à 6 % en 2011, 4,6 % en 2012, et 3 % en 2013, soit 95 milliards d’économies en trois ans. Or l’immigration extra-européenne coûte à elle seule 36 milliards d’euros par an à la France !

Nel 1997 Gualtiero Ciola pubblicava un’opera, poi ristampata, che costituiva un originale punto di riferimento per un’adeguata considerazione delle origini etniche dei popoli italiani. Nel suo corposo studio Noi, Celti e Longobardi, Ciola analizza le testimonianze archeologiche e linguistiche che hanno segnato il territorio della penisola italica, fornendo utili indicazioni per seguire nuovi percorsi di ricerca.

Nel 1997 Gualtiero Ciola pubblicava un’opera, poi ristampata, che costituiva un originale punto di riferimento per un’adeguata considerazione delle origini etniche dei popoli italiani. Nel suo corposo studio Noi, Celti e Longobardi, Ciola analizza le testimonianze archeologiche e linguistiche che hanno segnato il territorio della penisola italica, fornendo utili indicazioni per seguire nuovi percorsi di ricerca.

Comenzamos por señalar la corriente darwinista que reinterpretó la lucha de clases como una lucha de razas, en la que destaca la obra de Ludwig Gumplowicz (Der Rassenkampf), judío de origen polaco que, casualmente, sería considerado como maestro sociológico por el germanista radical Ludwig Woltmann. Precisamente, increpado Gumplowicz por su discípulo Woltmann al haber abandonado el concepto de raza, el sociólogo nostálgico respondió en los siguientes términos: «Me sorprendía … ya en mi patria de origen el hecho de que las diferentes clases sociales representasen razas totalmente heterogéneas; veía allí a la nobleza polaca, que se consideraba con razón como procedente de un tronco completamente distinto del de los campesinos; veía la clase media alemana y, junto a ella, a los judíos; tantas clases como razas … pero, en los países del occidente de Europa sobre todo, las distintas clases de la sociedad hace ya mucho tiempo que no representan otras tantas razas antropológicas y, sin embargo, se enfrentan las unas a las otras como razas distintas …».

Comenzamos por señalar la corriente darwinista que reinterpretó la lucha de clases como una lucha de razas, en la que destaca la obra de Ludwig Gumplowicz (Der Rassenkampf), judío de origen polaco que, casualmente, sería considerado como maestro sociológico por el germanista radical Ludwig Woltmann. Precisamente, increpado Gumplowicz por su discípulo Woltmann al haber abandonado el concepto de raza, el sociólogo nostálgico respondió en los siguientes términos: «Me sorprendía … ya en mi patria de origen el hecho de que las diferentes clases sociales representasen razas totalmente heterogéneas; veía allí a la nobleza polaca, que se consideraba con razón como procedente de un tronco completamente distinto del de los campesinos; veía la clase media alemana y, junto a ella, a los judíos; tantas clases como razas … pero, en los países del occidente de Europa sobre todo, las distintas clases de la sociedad hace ya mucho tiempo que no representan otras tantas razas antropológicas y, sin embargo, se enfrentan las unas a las otras como razas distintas …». Las tesis iniciales de Woltmann, no obstante lo anterior, irían cobrando un intenso matiz germanista, hasta el extremo de no tolerar la unión de los alemanes con otras ramas de la familia nord-europea. Es más, una posible asimilación de los otros pueblos germánicos –daneses, holandeses, etc- la condicionaba a su dominio por parte de una gran Alemania. La extravagancia de Woltmann, que partía de la idea según la cual el valor de una civilización depende de la cantidad de raza rubia germana que contenga, le hizo asegurar que los grandes hombres (nobles, políticos, artistas, filósofos, etc) más representativos de la cultura y la sociedad italiana, francesa y española eran, sin duda alguna, de ascendencia germánica, pensando que sus cualidades anímicas y espirituales revelarían siempre los caracteres antropológicos del germano, dolicocéfalo y rubio, aun cuando su apariencia física externa fuera la de un alpino braquicéfalo o la de un oscuro mediterráneo.

Las tesis iniciales de Woltmann, no obstante lo anterior, irían cobrando un intenso matiz germanista, hasta el extremo de no tolerar la unión de los alemanes con otras ramas de la familia nord-europea. Es más, una posible asimilación de los otros pueblos germánicos –daneses, holandeses, etc- la condicionaba a su dominio por parte de una gran Alemania. La extravagancia de Woltmann, que partía de la idea según la cual el valor de una civilización depende de la cantidad de raza rubia germana que contenga, le hizo asegurar que los grandes hombres (nobles, políticos, artistas, filósofos, etc) más representativos de la cultura y la sociedad italiana, francesa y española eran, sin duda alguna, de ascendencia germánica, pensando que sus cualidades anímicas y espirituales revelarían siempre los caracteres antropológicos del germano, dolicocéfalo y rubio, aun cuando su apariencia física externa fuera la de un alpino braquicéfalo o la de un oscuro mediterráneo.

Paul E. Gottfried

Paul Gottfried has spent the last thirty years writing books and generating hostility among authorized media-approved conservatives. His most recent work is his autobiography Encounters; and he is currently preparing a long study of Leo Strauss and his disciples. His works sell better in Rumanian, Spanish,Russian and German translations than they do in the original English, and particularly in the Beltway. Until his retirement two years hence, he will continue to be Raffensperger Professor of Humanities at Elizabethtown College in Elizabethtown, PA.